As mentioned this week, the long term uptrend line and the double bottom support at 13,500 were broken down this week, and that puts the market in a bear mode.

The TSE Bullish % is now valued at 47%, below my threshold of 47.5% and that confirms the bear trend and suggest that any bounce may be weak.

I see a lot of red on the map.

We present below, an evaluation of all the sectors of the Canadian market. The significant events are:

-1- Three sectors, Metals and Mining, Materials and Income Trust had breakdowns as shown in the Last Event column. Income Trusts moved from a bull to a bear trend in the process joining Healthcare which has been in a bear for awhile.

-2- Technology and Utilities are now in a column of “O” leaving Consumers Staple as the only sector bucking the trend.

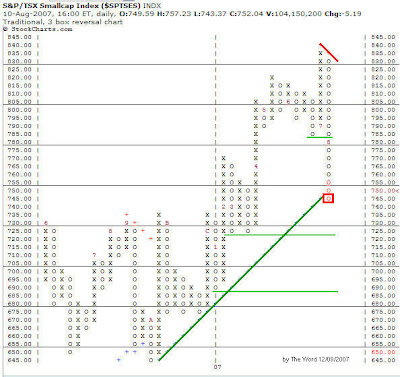

We added this week a table in order to monitor the MidCap, SmallCap and Gold sector of the market. As you can see, the TSX Composite breakdown was accompanied by a similar long term uptrend line breakdown in Small Caps which is now also in a bear market.

A chart of the TSX MidCap index shows that we are very near the long term uptrend line on this index. What will this week bring?

Finally, the chart below shows the SmallCap index breakdown discussed above.

In conclusion, I hope this review of the Canadian market from a Point & Figure perspective will complement the information you typically use to make your on mind on the future course of the market. That is the objective.

The Word

therealword@gmail.com