One keeps reading and hearing that the Sensex has been one of the worst performers among global stock indices over the past one year. So I decided to take a look at some of the leading global indices (in blue) to check whether the Sensex (in green) has been an underperformer or not.

Here is what I found:-

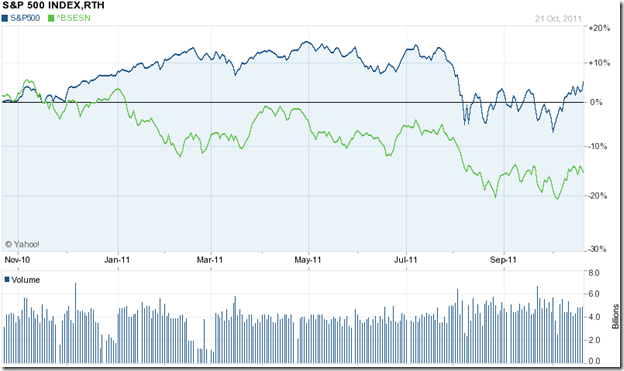

S&P 500 vs. Sensex

The S&P 500 index has not only outperformed the Sensex by a wide margin, but has eked out a 5% gain over the past year despite the economic slow down in the USA.

FTSE 100 vs. Sensex

The UK economy is in a bad shape with growth almost non-existent. Still, the FTSE 100 has outperformed the Sensex right through the past year – despite losing 5%.

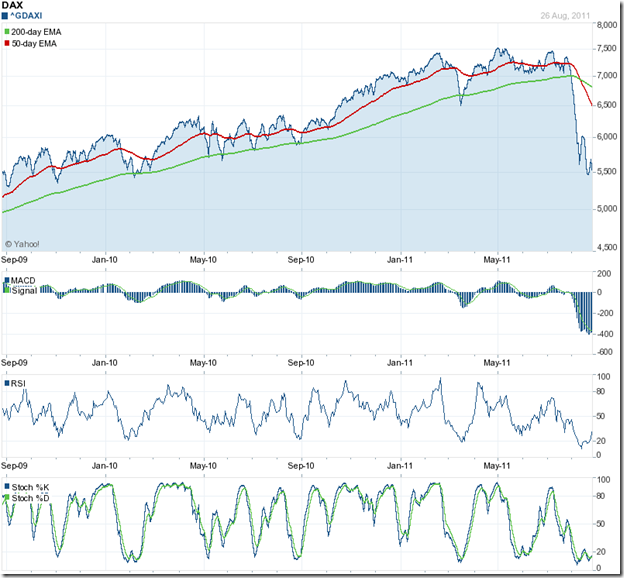

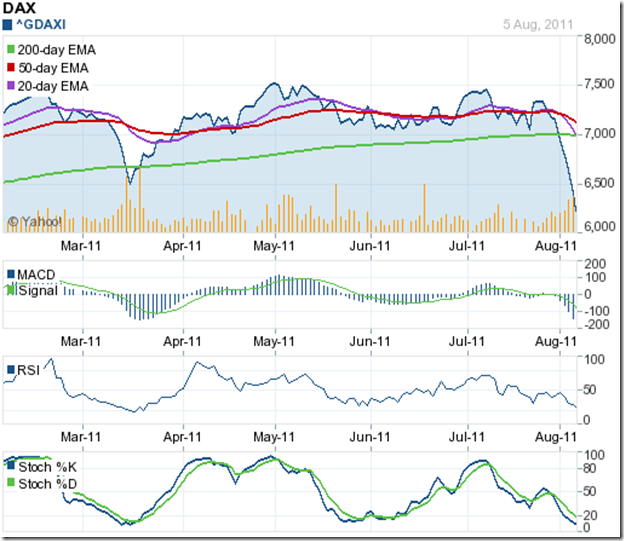

DAX vs. Sensex

The German economy is stronger than the UK’s, but the DAX has lost 10% over the past year. Despite the steep fall in Aug ‘11, it managed to outperform the Sensex.

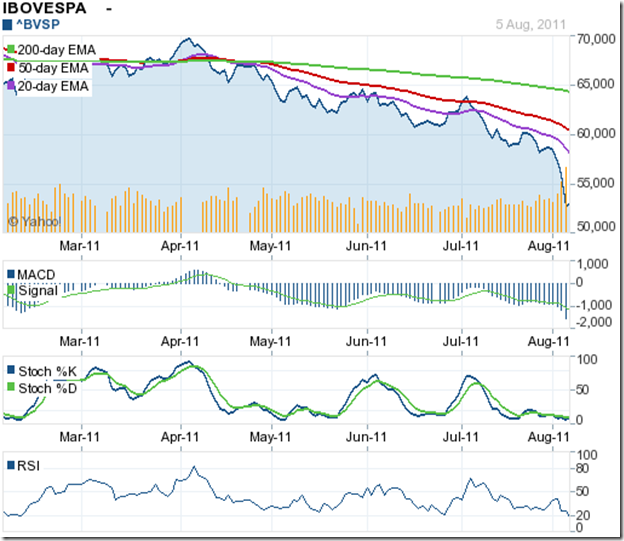

Bovespa vs. Sensex

India is no match for Brazil on the soccer field, but the Sensex has managed to outperform the Bovespa by more than 5% over the past year.

MERVAL vs. Sensex

The Argentine index has not gained during the past year, but has outperformed the Sensex by a wide margin.

Hang Seng vs. Sensex

Hang Seng is the only other major global index that has underperformed the Sensex, thanks to its steep fall over the last two months.

Jakarta Composite vs. Sensex

The Indonesian index has been one of the best performers in Asia, though it has made zero gains during the past year. It has significantly outperformed the Sensex.

KLCI vs. Sensex

The Malaysian index outperformed the Sensex throughout the past year, though it has lost about 3%.

The Sensex has indeed been an underperformer against major global indices – with the exception of the Bovespa and the Hang Seng. India’s economy is still growing in spite of the recent slow down due to high interest rates. When the turnaround comes, the index is likely to become an outperformer.