Both Sensex and Nifty indices have been sliding down in bear markets for the past 13 months. There doesn’t seem to be any signs of a recovery. In fact, the economic situation – both in India and abroad – seem to be heading from bad to worse. This is not the best time for investing in the stock market, because the market can fall much further.

What should investors do? Where can they park their savings and hope to get reasonable returns without undue risk? In this month’s guest post, Nishit discusses a few investment options that can provide decent returns without taking on too much risk.

---------------------------------------------------------------------------------------------------------

With the markets falling continuously, the question uppermost in people’s minds is where to invest their hard earned money? Let us explore a few options.

PPF investment limits have been increased from Rs 70,000 to Rs 1 lakh, and the interest rate has been increased to 8.6%. This is one of the safest options for investors and should be used first before looking at anything else. Next it is tax saving time and IDFC has come with Infrastructure bonds which provide tax saving on an additional Rs 20,000 over and above the 1 lakh cap under Section 80C. These bonds have an interest yield of 9%. If you are in the highest tax bracket you will save additional tax of Rs 6,000. Thus, in the month of December itself, additional avenues to invest Rs 50,000 are possible.

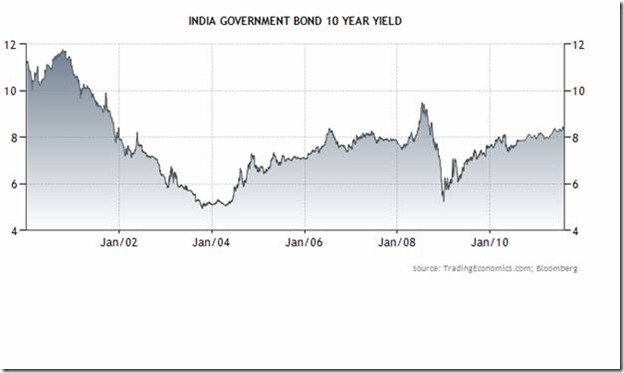

Gilt funds are a good place to be in. In the past 1 month, bond yields have fallen from 8.97% to 8.4%. Bond funds have given a return of 4.5%. Now, this performance will not be repeated every month but one may get an annualized return of about 15% in the next 2 years in gilt funds.

A slightly more sophisticated way of generating money in a falling market is writing call options of the Nifty against your portfolio. For example, Jan 5200 Nifty call is trading at Rs 32. The margin for writing 1 lot is around Rs 20,000. So, for 5 lots one would get an inflow of Rs 7,500 and the margin of 1 lakh would be blocked till Jan 25th 2012. This is another safe way of generating steady returns in a bear market.

HDFC Top 200 is a very good equity fund where one can continue to do a SIP every month. This fund has yielded a return of 22% over the last 15 years. During this time, several bear and bull markets have come and gone.

The above mentioned are just a few avenues for putting in one’s money as per his or her risk appetite. Also, there is the safe bank fixed deposit giving very good returns for risk-averse investors. My advice for those not needing that cash in a hurry is to lock in the money for next 5 years for returns between 9-10%, depending on the bank.

Also, there is the L&T NCD trading on the NSE which has an expiry of about 7.5 years still and yield is about 10%. The benefit is one gets the interest credited twice to the bank account.

---------------------------------------------------------------------------------------------------------

(Nishit Vadhavkar is a Quality Manager working at an IT MNC. Deciphering economics, equity markets and piercing the jargon to make it understandable to all is his passion. "We work hard for our money, our money should work even harder for us" is his motto.

Nishit blogs at Money Manthan.)