Michael Moore’s hard-hitting documentary, ‘Bowling for Columbine’, made an interesting point. The government and the TV channels do their best to keep Americans in a state of fear – so that they consume more! Remember the Y2K scare? Shelves of department stores were empty of water, canned food, torches, batteries, guns and a myriad other goods required for survival. People bought truck loads of the stuff. On Jan 1 2000 – nothing happened. No crash, no collapse. But a lot of goods consumed.

Following the economic downturn in 2008, a similar fear scenario played out across the USA. It was going to be worse than the 1929 depression. There would be riots on the streets. The US dollar was not going to be worth the paper it was printed on. Stock markets would crash and retirement benefits will vanish into thin air (a la Enron). Yes, unemployment is still high and the housing market is in doldrums. The doomsday theories have only led to a phenomenal rush to buy gold – but Americans are not getting fooled this time. They are tightening their belts – well some are – and digging in for the long haul.

In this month’s guest post, Kiran provides a ‘ground-zero’ report of the US economy.

------------------------------------------------------------------------------------------

Global Growth Slow, But Continues…

The global recovery from 2009-10 has broadened to encompass more enterprises, more countries and more elements that show aggregate demand. Improving labour market conditions in high-income countries and strongly expanding domestic demand in developing countries augurs well for a continued maturity of the recovery that is more than two years old.

The recovery here in the USA has gained strength over the past 8 to 12 months and shows signs of becoming more self-sustaining, although all of it has happened in an atmosphere of disbelief that it is real. Of course, Aug 2nd 2011 deadline for raising the debt limit being around the corner, makes this recovery a huge suspect in the minds of many without a Quantitative Easing – Part 3 (QE3). At this point, QE3 is not being discussed although Bernanke has hinted that he would be ready to pull it off if the situation warrants it. In the US, significant gains in levels of manufacturing and services activity, business re-investment and technology upgrades have helped improve conditions in U.S. labour and professional services markets. Most of the technology upgrades that we see are destined to either reduce labour costs, or reduce the current monthly expenditure (lower powered servers, more automation, VoIP, Telepresence, Call Center automation etc).

The recovery in Europe continues to face substantial uncertainty surrounding sovereign debt in several Eurozone members (code named PIIGS for each of the individual countries in huge debts). Germany and France have shown increasing strength; with unemployment in Germany now well below pre-crisis levels. In many other countries, growth is becoming constrained by fiscal consolidation programs, ongoing banking-sector restructuring and a skepticism regarding the financial sector. Perception is more important than reality, which is why gold is still trending upwards.

The horrible natural disaster and ensuing nuclear challenge in Japan will shape economic and human developments in that country for years to come. More importantly, all of the nuclear power plants in the US that are built similar to the one in Japan are under re-engineering to avoid a similar disaster. Despite the very real human and wealth losses associated with the crisis, its negative impact on GDP growth is expected to be temporary.

Overall, global growth is projected to ease from 3.8 percent in 2010 to 3.2 percent in 2011, before picking up to 3.6 percent in each of 2012 and 2013. The slowdown for high-income countries mainly reflects very weak growth in Japan due to the after-effects of the earthquake and tsunami. Japanese companies doing business worldwide are just starting to turn around and getting the business environment back to normal. Growth in the remaining high-income countries is expected to remain broadly stable at around 2.5 percent through 2013, despite a gradual withdrawal of the substantial fiscal and monetary stimulus introduced following the financial crisis to prevent a more serious downturn.

Contrary to the above, much of the rest of the world, meanwhile, is brimming with energy and hope. Policymakers in China, Brazil, India, and Turkey worry about too much growth, rather than too little. Rate increases in India and China are perfect proofs of efforts to curb inflation. By some measures, China is already the world’s largest economy, and emerging-market and developing countries account for more than half of the world’s output. The consulting firm McKinsey has christened Africa (part of the BRICA with the A standing for Africa), long synonymous with economic failure, as the land of “lions on the move.” That is an amazing turn for an economy – recall the pictures circulating on the Internet of kids who do not have water to drink and food to eat, and are just sitting there on the roadside. Well, a lot of that might be just a memory in Africa in the next decade.

Overall, for the cluster of developing countries growth is projected to decline from 7.3% to 6.2% between 2010 and 2012 before firming somewhat in 2013, reflecting an end to bounce-back factors that served to boost growth in 2010. The BRIC nations might have its own growth factors that are uniquely defined based on the organic growth within. Hence, their economies are more in the 8% to 10% GDP growth range, although inflation is a cause for concern in these hot economies. So, monetary tightening will continue to happen to temper the inflation.

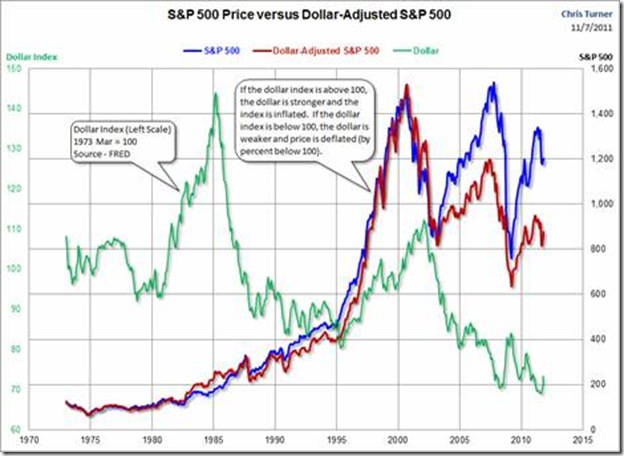

Bringing it to today, perhaps for the first time in modern history, the future of the global economy lies in the hands of developing countries. The United States and Europe struggle on as wounded giants, casualties of the financial excesses and for the next few days, political paralysis. Economies of USA and Europe are shackled by heavy debt burdens with years of stagnation or slow growth in the offing and definitely a widening inequality – although they are not going to crash, contrary to emotional and eye catching dire predictions by some people. Analyzing the profile of family groups, and looking into their financial profiles, clearly shows the excesses in US from an income and asset standpoint. In the next one to two decades we will create ‘the haves’ and ‘the have nots’ even in these developed countries since the poor are getting poorer (with less and less government programs) and the rich will get richer buying more assets at low prices, for an eventual recovery. See below for a couple of interesting graphics:

![clip_image002[5] clip_image002[5]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEifWTNF8uQriL4mMAkhqd1NJesTtZRJ6Aa_er_u7gP5aQSgaNzRy2ktacjY7kyibMa3W-EUWop_C-kMWFSLjKu5Km0evN8y6Dh-pPPM5SYwmxnoe_XUN-jpUNrMQhhvoEtLLm8NMqJ15x8/?imgmax=800)

------------------------------------------------------------------------------------------

KKP (Kiran Patel) is a long time investor in the US, investing in US, Indian and Chinese markets for the last 25 years. Investing is a passion, and most recently he has ventured into real estate in the US and also a bit in India. Running user groups, teaching kids at local high school, moderating a group in the US and running Investment Clubs are his current hobbies. He also works full time for a Fortune 100 corporation.

![clip_image002[5] clip_image002[5]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEifWTNF8uQriL4mMAkhqd1NJesTtZRJ6Aa_er_u7gP5aQSgaNzRy2ktacjY7kyibMa3W-EUWop_C-kMWFSLjKu5Km0evN8y6Dh-pPPM5SYwmxnoe_XUN-jpUNrMQhhvoEtLLm8NMqJ15x8/?imgmax=800)