A month ago, the chart patterns of the Jakarta Composite, Singapore Straits Times and Malaysia KLCI indices were looking bullish, after recovering well from bear attacks. The bulls have been trying hard to regain control and momentum. But the bears are still reluctant to give up ground. In the process, some interesting chart patterns have been forming.

Jakarta Composite Index Chart

The Jakarta Composite index never entered a bear market technically. The 50 day EMA had bounced off the 200 day EMA back in Oct ‘11, and has been moving up since. After a sharp drop below the 200 day EMA and an equally sharp recovery, the index has been trading within an upward-sloping channel for the past four months.

The interesting thing to note is that the index faced strong resistance from the 4030 level, where it had earlier faced resistance in Jul, Aug and Sep ‘11. As a result, the index has not been able to make any headway for the last two months – though it is trading above its rising 200 day EMA and is technically in a bull market.

The technical indicators are mildly bullish. The MACD is barely positive and has merged with its signal line. The ROC has crossed above its 10 day MA into positive territory, but appears unable to decide which direction it wants to go. The RSI is resting at its mid-point. The slow stochastic has dropped from its overbought zone.

The bulls still have some work left to be able to test the Aug ‘11 top of 4196.

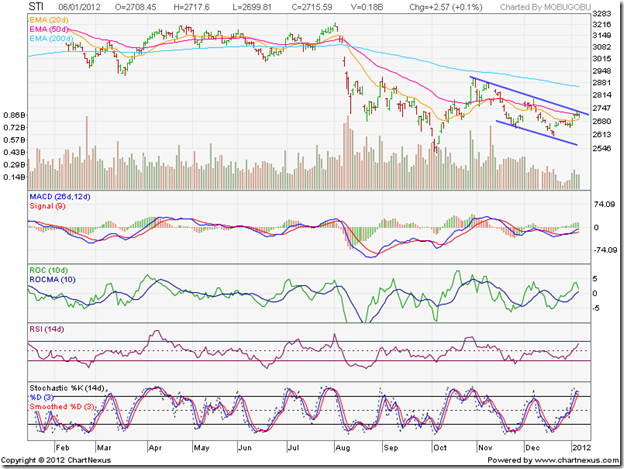

Singapore Straits Times Index Chart

The Singapore Straits Times index climbed smoothly above all three EMAs. The ‘golden cross’ of the 50 day EMA above the 200 day EMA (marked by light blue oval) technically confirmed a return to a bull market. But the lower edge of the gap (at 3030 level) formed in Aug ‘11 is providing strong resistance to the bull rally.

After a short correction down to its rising 50 day EMA, the index has bounced up smartly. But the technical indicators are yet to turn bullish. The MACD is still positive, but has made a bearish ‘inverted saucer’ pattern and is falling below its signal line. The ROC has dropped into negative territory. The RSI is below its 50% level. The slow stochastic bounced up from the edge of its oversold zone, but is below its 50% level.

The bulls need to concentrate their efforts on closing the Aug ‘11 gap before they can hope to regain control.

Malaysia KLCI Index Chart

The Malaysia KLCI index chart is clearly trending up in a bull market, and looks the most bullish of the three indices. After coming within two points of its Jul ‘11 top of 1597, the KLCI index had to beat a slight retreat. Will the brief setback turn into a correction?

The technical indicators are suggesting the possibility. Volumes have reduced considerably and all four indicators touched lower tops (marked by blue arrows) as the index rose to test its previous top. The combined negative divergences may pull the index down some more.

Note that all three EMAs are rising in tandem and the KLCI is trading above them. That is a clear sign of a bull market. Do not make the mistake of shorting a rising index. Use any dips to add.

Bottomline? The Asian index chart patterns are back in bull markets. The bears haven’t given up the fight, but are slowly losing ground. Once the nearby resistance levels are overcome, the bulls will regain complete control. Add the dips and maintain trailing stop-losses.