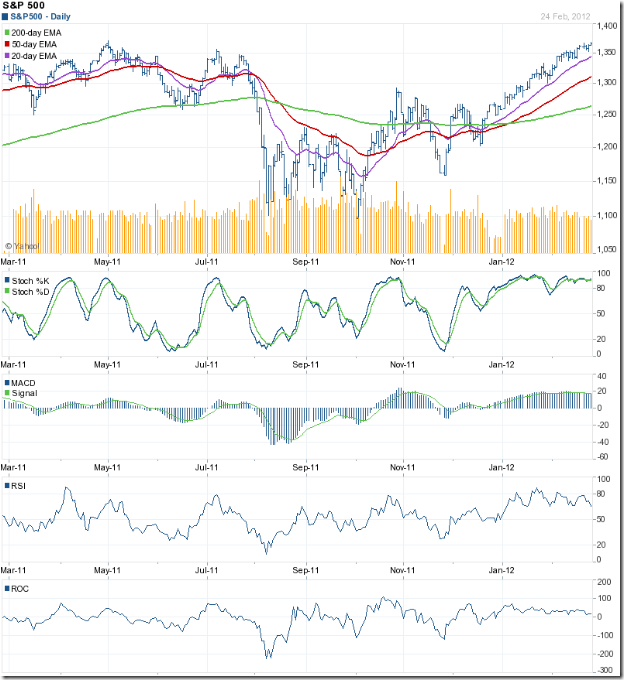

S&P 500 Index Chart

The inevitable happened. The bulls finally managed to push the S&P 500 index chart to new 52 week highs – both on intra-day and closing basis. The index touched an intra-day high of 1378 on Feb 29 ‘12 and a closing high of 1374 on Mar 1 ‘12. Is it time for celebration or caution?

All three EMAs are rising and the index is trading above them. The bulls appear to be in complete control. But there are a few concerns. The index is trading too far above its 200 day EMA, which is a precursor to a correction. Despite a spike up on Feb 29, volumes have been sliding. A bull rally needs volume support to sustain.

The technical indicators are bullish, but continue to show negative divergences. The slow stochastic is inside its overbought zone, but drifting down. The MACD is positive and touching its signal line, but slowly losing ground. The RSI is above its 50% level, but making a bearish pattern of lower tops and lower bottoms. The ROC is barely positive, but touching lower tops. Stay invested with a trailing stop-loss.

Is the slow-growing US economy reaching stall speed? Some of the data points suggest as much. Weekly unemployment claims remained flat at 351,000. ISM Manufacturing index declined to 52.4 from 54.1 in Jan. Durable goods orders declined by 4% in Jan after 3 straight monthly increases. Home prices continued to fall. But it wasn’t all bad news. Car sales crossed the 15 Million mark in Feb – a 4 yr high. Sales of previously owned homes rose 4.3% in Jan – helped by the lower prices.

FTSE 100 Index Chart

The FTSE 100 chart closed marginally lower for the week. The bull rally appears to have hit a road-block below the 6000 level. The index is still trading above all three EMAs, so the bull rally is under no immediate threat. However, a correction seems to be around the corner.

The technical indicators have weakened further, and are on the verge of turning bearish. The slow stochastic has dropped from the overbought zone, but remains above the 50% level. The MACD is positive, but has slipped below the falling signal line. The RSI is resting at the 50% level. The ROC is at the ‘0’ line, after a brief dip into negative territory. A correction down to the 5800 level can be used as a buying opportunity. A deeper correction may put the nascent bull market in jeopardy.

Spectre of a double-dip recession in the UK may be fading. PMI for construction increased to 54.3 from 51.4 in Jan. PMI for services dropped to 53.8 from 56 in Jan. Remember that a figure above 50 means expansion. The big problem remains unemployment, which is at a 17 yr high. Austerity measures are not helping in job creation. High oil prices are another concern.

Bottomline? Chart patterns of the S&P 500 and FTSE 100 indices are in bull markets, which have climbed higher in spite of negligible growth in the underlying economies. Easy availability of liquidity has helped in propelling the markets. At some point, the weak fundamentals may drag the markets down. Till then, stay invested with trailing stop-losses.