Jumat, 23 September 2011

Stock Index Chart Patterns – Shanghai Composite, Korea KOSPI, Taiwan TSEC – Sep 23 ‘11

Jumat, 02 September 2011

Stock Index Chart Patterns – Shanghai Composite, Korea KOSPI, Taiwan TSEC – Sep 02 ‘11

Shanghai Composite Index Chart

The Shanghai Composite index chart pattern is sliding deeper into a bear market, even as the Chinese economy shows considerable growth. Is the index trying to give us a message – that the growth figures may not be that reliable? Or, may be it is providing an advance warning of what is to follow in the US and Eurozone stock indices?

After topping out near the 6000 level way back in Oct ‘07, the Shanghai Composite failed to recover from the subsequent bear market. Periodic efforts to climb above the 3000 level have been resisted strongly by the bears.

The Aug 9 ‘11 low of 2438 may soon be tested and broken. The technical indicators are suggesting as much. The slow stochastic and the RSI have both slipped below their 50% levels. The MACD is negative, and about to cross below its signal line. The ROC is also negative. All three EMAs are falling, with the index trading below them – the sign of a bear market.

Korea KOSPI Index Chart

The Korea KOSPI index touched a new 15 month low of 1704 on Aug 22 ‘11, and then mounted a spirited rally to climb above the 20 day EMA. Note that the ‘death cross’ of the 50 day EMA below the 200 day EMA has confirmed a bear market. Such counter-trend rallies are likely to be used by bears to sell. It won’t be a surprise if the index fails to move above the falling 50 day EMA.

The technical indicators are showing signs of bullishness. The slow stochastic and the RSI have risen above their 50% levels. The MACD is negative, but rising above its signal line. But the ROC is showing a loss of momentum by dropping back towards negative territory.

Taiwan TSEC Index Chart

The Taiwan TSEC index chart has fared marginally better than the KOSPI. It touched a higher bottom before embarking on its rally. Though the index has crossed above the 20 day EMA, the resistance from the 50 day EMA is likely to be more difficult to overcome.

The technical indicators are mildly bullish. The slow stochastic has risen above the 50% level. The RSI is struggling a bit to cross its 50% level. The ROC has not been able to climb into the positive zone. The MACD is negative, but rising above its signal line.

Bottomline? The chart patterns of the Asian indices are trading in bear markets. The Shanghai Composite has already spent the last three months in bear country. The KOSPI and TSEC are more recent entrants, and are trying very hard to return back to a bull market. But resistances from the 50 day EMA and the gap formed on Aug 5 ‘11 may overwhelm their efforts. Remain on the sidelines, and be patient. Lower chart levels are likely.

Sabtu, 06 Agustus 2011

Global indices: crack under bear attack

It wasn’t just the Indian market that suffered at the hands of the bears. Global indices cracked as well, even the few that have been showing remarkable resilience so far.

Our trouble-shooting Finance Minister was quick to state that Indian markets were only feeling the effect of a global sell-off, and there was no reason to panic. Those are mere words to shore up our falling market.

The time for soothing words is long over. It is time for action. Tough policy decisions – however unpopular – need to be taken and implemented. Soon. Bears are about to take complete control.

Here are the 6 months closing chart patterns of a few global market indices:

Shanghai Composite China

The Shanghai Composite index has been trading sideways ever since it dropped below the 200 day EMA back in Apr ‘10. It has once again dropped below all three EMAs. Last Friday’s fall has no special significance for a index already struggling to keep the bears away.

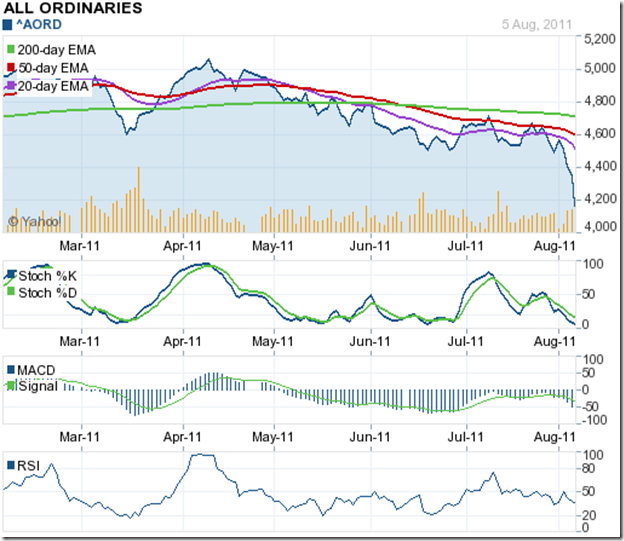

Australia All Ordinaries

The Australia All Ordinaries index has been in a down trend since Apr ‘11. The ‘death cross’ of the 50 day EMA below the 200 day EMA in Jun ‘11 confirmed a bear market. Friday’s panic selling has pushed the index deeper into bear territory.

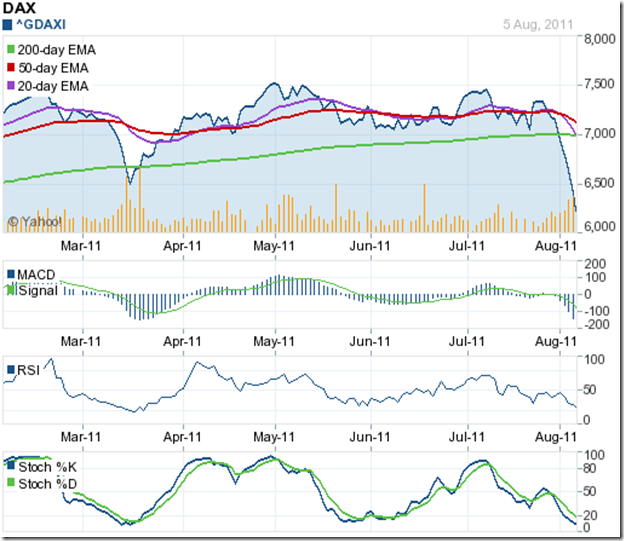

DAX Germany

Except for a few days in Mar ‘11, the DAX index had been in a bull market – trading above a rising 200 day EMA - till Jul ‘11. The index slipped below the 7000 level and the 200 day EMA on Mon. Aug 1 ‘11, and continued to fall through the past week. The ‘death cross’ will confirm a bear market.

Madrid General Spain

The Madrid General index has been in a bear market since May ‘11, making a pattern of lower tops and lower bottoms. Things were bad. They have just turned worse.

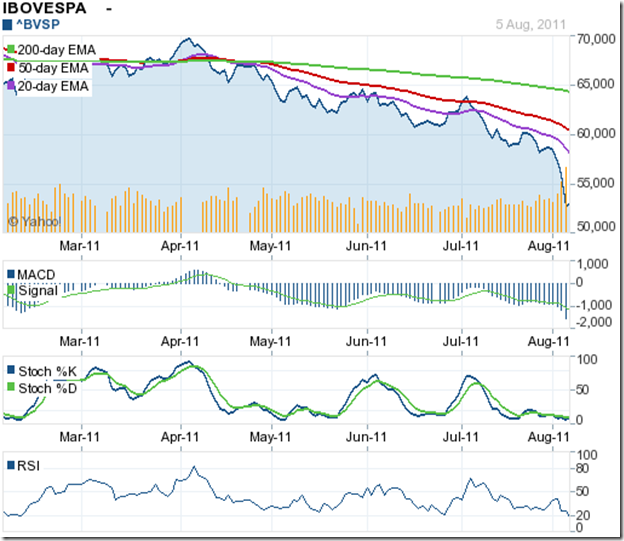

IBOVESPA Brazil

The IBOVESPA index has been trending down in a bear market since Apr ‘11. Last week’s selling has pushed the index below a downward sloping channel.

MERVAL Argentina

The Argentine MERVAL index had been trading with a slight downward bias, but stayed above a rising 200 day EMA till Jul ‘11 (except for a few days in Jun ‘11). Friday’s huge drop has changed the equation in favour of the bears.