It wasn’t just the Indian market that suffered at the hands of the bears. Global indices cracked as well, even the few that have been showing remarkable resilience so far.

Our trouble-shooting Finance Minister was quick to state that Indian markets were only feeling the effect of a global sell-off, and there was no reason to panic. Those are mere words to shore up our falling market.

The time for soothing words is long over. It is time for action. Tough policy decisions – however unpopular – need to be taken and implemented. Soon. Bears are about to take complete control.

Here are the 6 months closing chart patterns of a few global market indices:

Shanghai Composite China

The Shanghai Composite index has been trading sideways ever since it dropped below the 200 day EMA back in Apr ‘10. It has once again dropped below all three EMAs. Last Friday’s fall has no special significance for a index already struggling to keep the bears away.

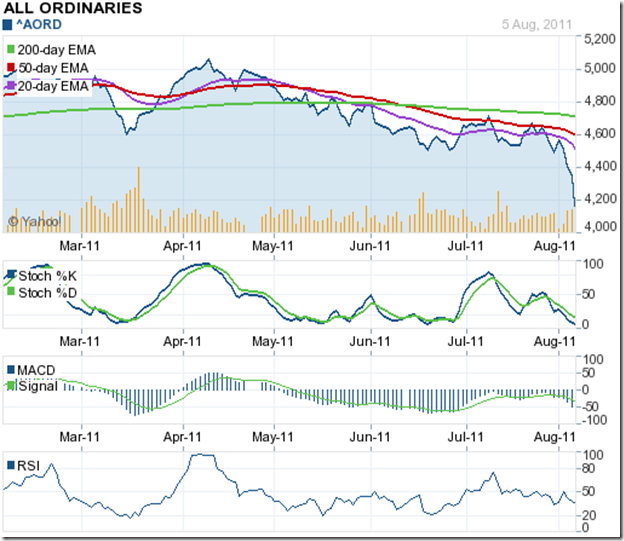

Australia All Ordinaries

The Australia All Ordinaries index has been in a down trend since Apr ‘11. The ‘death cross’ of the 50 day EMA below the 200 day EMA in Jun ‘11 confirmed a bear market. Friday’s panic selling has pushed the index deeper into bear territory.

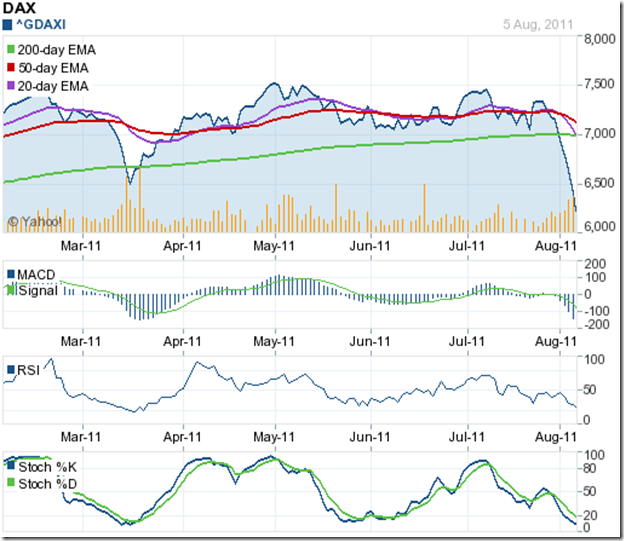

DAX Germany

Except for a few days in Mar ‘11, the DAX index had been in a bull market – trading above a rising 200 day EMA - till Jul ‘11. The index slipped below the 7000 level and the 200 day EMA on Mon. Aug 1 ‘11, and continued to fall through the past week. The ‘death cross’ will confirm a bear market.

Madrid General Spain

The Madrid General index has been in a bear market since May ‘11, making a pattern of lower tops and lower bottoms. Things were bad. They have just turned worse.

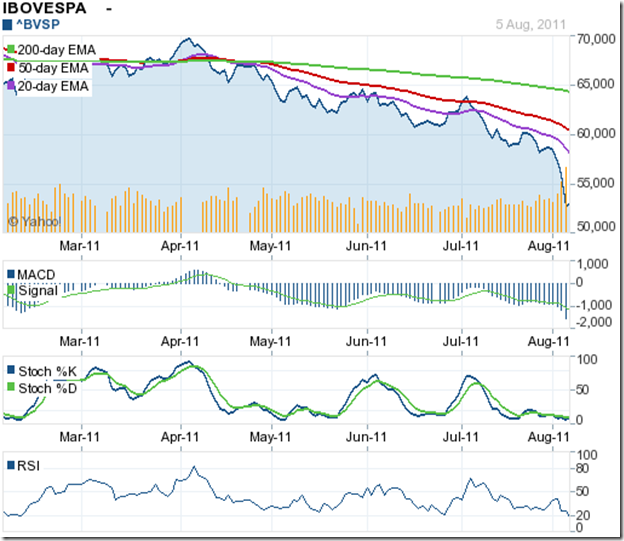

IBOVESPA Brazil

The IBOVESPA index has been trending down in a bear market since Apr ‘11. Last week’s selling has pushed the index below a downward sloping channel.

MERVAL Argentina

The Argentine MERVAL index had been trading with a slight downward bias, but stayed above a rising 200 day EMA till Jul ‘11 (except for a few days in Jun ‘11). Friday’s huge drop has changed the equation in favour of the bears.