S&P 500 Index Chart

The S&P 500 index chart dropped like a stone - almost to the 200 day EMA, thanks mainly to the uncertainty surrounding the debt ceiling wrangle in Washington DC. The ‘resolution’ of the self-made debt crisis over the weekend may cause a temporary relief rally, but market sentiment appears to have taken a hit.

The index is again trading below its 20 day and 50 day EMAs, and has formed a bearish pattern of lower tops and lower bottoms. In spite of the rising 200 day EMA, the S&P 500 has been trading within a sideways range between 1250 and 1370 for the past 6 months.

The technical indicators have weakened. The slow stochastic is about to enter its oversold zone. The MACD is below its signal line and about to slip into negative territory. The RSI is below the 50% level. The contours of the debt deal in Washington will determine market direction this week.

The economy continues to sputter without much movement. Initial unemployment claims edged below the 400,000 mark after 15 weeks. The AAII Sentiment Survey showed bullish sentiment at a 5 week low of 37.8%, and bearish sentiment at a 5 week high of 31.4%. The University of Michigan Consumer Sentiment index at 63.7 was the lowest since Mar ‘09. Q2 GDP growth was a paltry 1.3%.

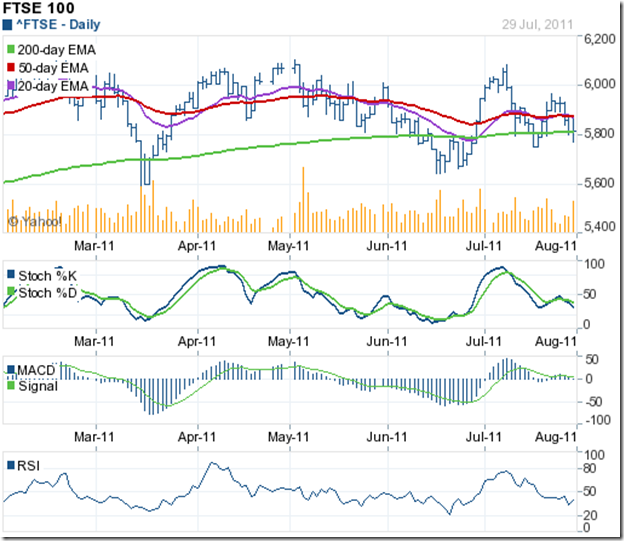

FTSE 100 Index Chart

The technical indicators were flashing alarm signals last week. It came as no surprise when the FTSE 100 dropped below the 200 day EMA. The index just about managed to close at the level of the long-term moving average at the end of the week.

There may not be much respite for the bulls. The slow stochastic is below the 50% level and headed down. The MACD is below the signal line and barely positive. The RSI is below the 50% level. The good news is that the 200 day EMA is still rising, and the FTSE 100 index is trading within the six months long sideways range between 5600 and 6100.

The less said about the UK economic recovery, the better. Q2 GDP growth was a miniscule 0.2% – much below expectations. If growth falters any further, policymakers may not have many options left. The austerity measures are clearly not working.

Bottomline? The chart patterns of S&P 500 and FTSE 100 indices are trading sideways with a slight upward bias for the past 6 months. The respective economies are growing, but ever so slowly. Stay invested, with stop-losses at the lower edge of the respective trading ranges. The intrepid can choose to trade the ranges.