Both index charts – BSE Sensex and NSE Nifty – show classic break outs above down trend lines followed by pullbacks and upward bounces from the down trend lines. That should mean that trend reversals have occurred and it is time to buy. But all is not well as yet.

Results of the elections in five states have come and gone. The market was not expecting the thrashing that the Congress Party got at the hustings. There are rumblings from UPA partners about big-brotherly treatment. Another surprise was the 75 bps cut in the CRR announced by the RBI prior to its Mar 15 review meeting – probably to preempt the likely liquidity shortfall in the system due to advance tax payments. The better-than-expected manufacturing IIP number has further confused market players.

RBI’s Mar 15 meeting appears to have become a non-event. The good IIP number may dash any possibility of a cut in interest rates. Some experts are already suggesting that the CRR cut will be inflationary. Very little is expected from the Mar 16 budget announcement from a government that has backed itself into a corner financially and politically, with its populist measures and inability to take tough decisions.

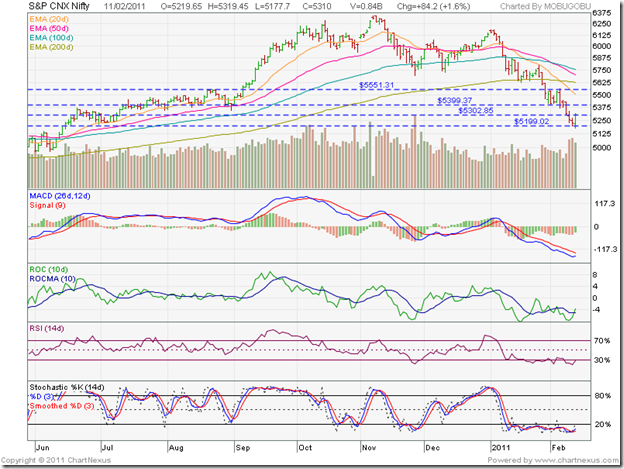

BSE Sensex index chart

In the weekly bar chart of the Sensex, last week’s bar shows a dip below the down trend line followed by a strong upward bounce. The ‘golden cross’ of the 20 week EMA above the 50 week EMA has not taken place yet. The technical confirmation of a bull market is still awaited.

The weekly technical indicators remain bullish, but there are signs of weakness. The MACD is positive and above its signal line, but it has stopped rising and the histogram has started falling. The ROC is positive and above its rising 10 week MA. The RSI has started falling towards its 50% level. The slow stochastic has slipped down from its overbought zone.

The pre-budget rally may turn out to be a sideways consolidation. A budget without any negative surprises may provide the trigger for the rally to resume in earnest.

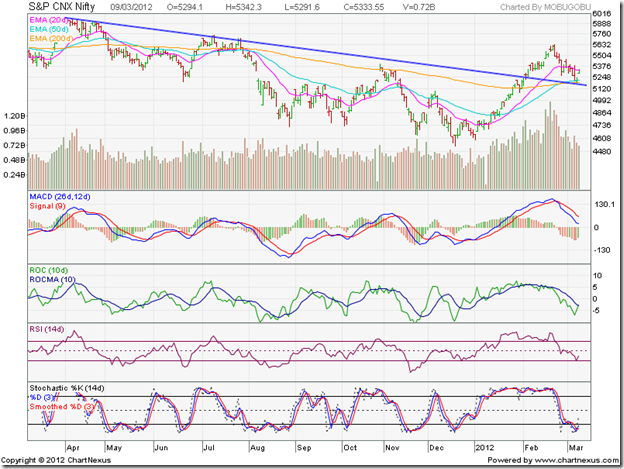

NSE Nifty 50 index chart

The daily bar chart pattern of the Nifty shows the break out above the down trend line, followed by a pullback and then a bounce up with a gap. Note that the volume bar is smaller on last Friday’s bounce up. That is not a positive sign for bulls.

The technical indicators are bearish, but showing signs of a turnaround. The MACD is falling below its signal line, but hasn’t yet entered negative territory. The ROC is negative, but is trying to cross above its 10 day MA. The RSI has bounced up from the edge of its oversold zone, but remains below the 50% level. The slow stochastic is trying to emerge from its oversold zone.

The 50 day EMA has crossed above the 200 day EMA, signalling a return to a bull market. But see what happened back in Apr ‘11 (left part of chart above). The 50 day EMA crossed above the 200 day EMA – only to drop back below it. Any fall below the down trend line can snuff out the bull rally.

Bottomline? Chart patterns of the BSE Sensex and NSE Nifty 50 indices have bounced up nicely after pullbacks to their down trend lines. Such bounces from resistance levels offer entry opportunities – provided there is adequate volume support and bullish technical indications. These seem to be lacking – probably because of the budget announcement hanging like the proverbial sword of Damocles. Those who are already invested should hold with stop-loss at the levels of the down trend lines. New entrants should await the budget announcement.