Last week, I had pointed out a bearish ‘reversal day’ pattern that got formed on Fri. Feb 4 ‘11 in both indices. Due to the negative market sentiments and bearish technical indicators, I had surmised that the next support zones on the indices may also get breached.

So far, the indices are dancing to the tune of technical analysis (or so it may seem!). Actually, it is net FII selling being countered by DII net buying that is causing the indices to drop step-by-step or, support zone by support zone. Note how the 200 day EMA, and the two support zones have temporarily stalled the down move. What about today’s sharp recovery? My guess would be short covering coupled with some investment buying.

BSE Sensex Index Chart

The selling on Tue. Feb 8 ‘11 convincingly breached the first support zone between 18050 and 18500, within which the Sensex had traded a week ago. The index dropped to the next support zone between 17500 and 17800, and traded within it for the rest of the week. Note that the 17500 level was breached intra-day on Feb 10 and Feb 11 ‘11, but the index managed to close within the support zone.

Technically, the second support zone has not been broken yet – but it may be just a matter of time. The technical indicators are still quite bearish. The MACD is deep in negative territory and below its signal line. The ROC is also negative, but has moved above its 10 day MA and also made a slightly higher bottom. The RSI is trying to come out of the oversold zone. The slow stochastic seems quite content to stay inside the oversold zone.

The down move from Jan ‘11 has lasted 6 weeks. An upward bounce is likely, but may find resistance from the first support zone and the falling 20 day EMA. In case the Sensex manages to move up further, the 200 day EMA will be a tougher resistance to overcome. Note that the ‘death cross’ (50 day EMA falling below the 200 day EMA) hasn’t happened yet. Till it does, the bulls will remain in the game.

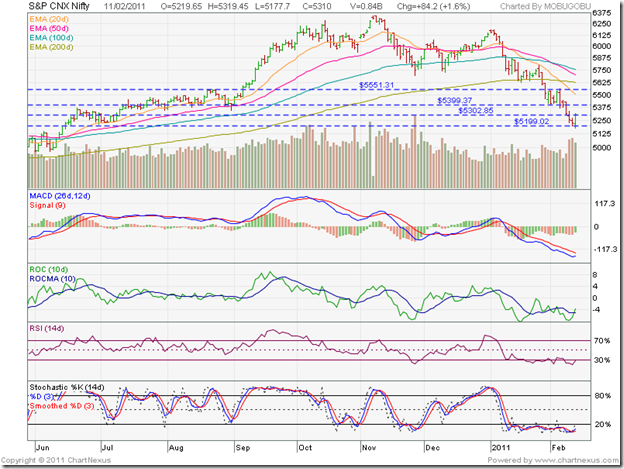

NSE Nifty 50 Index Chart

Today’s (Feb 11 ‘11) recovery in the Nifty 50 was accompanied by strong volumes – in fact, the highest up day volumes in more than two months. That gives a hint that it wasn’t just short-covering. Some investment buying may have taken place also. Note that today’s trading has formed a ‘reversal day’ pattern (lower bottom, higher close). A pullback rally may happen soon.

The technical indicators are quite bearish, though today’s buying seems to have injected a bit of life into them. The inflation rate has moderated a little, but the IIP number came as a disappointment. Any pullback may give the bears another opportunity to start selling.

The UPA government and the Opposition appears to have cut a deal regarding a JPC probe into the telecom 2G spectrum allotment scam. That may allow the budget session of parliament to go through unhindered. But that may not provide any bullish trigger for the markets. More skeletons seem to be tumbling out of the cupboards with each passing day. Half-educated businessmen are manipulating the nexus between the mafia and politicians for their own ends.

Politicians have been openly looting the country’s resources for many years. India’s growth story won’t filter into the hinterland unless corruption is controlled. Neither will our stock markets reach new highs till the negative perception changes about the future of our country. In the near term, sentiment is the key to stock market movements.

Bottomline? The chart patterns of the BSE Sensex and NSE Nifty 50 indices are on the verge of entering confirmed bear markets. Some stocks have fallen to their 52 week lows. Others have dropped below their book values. That doesn’t mean that all such stocks are worth buying. Please thoroughly check the fundamentals. Remember that in bear markets, you make money by selling the rises and then buying back at lower levels.