The previous technical analysis update of the stock chart pattern of Reliance Capital was posted back in Nov ‘09 (marked by a grey vertical line on the chart below). The stock price had corrected after touching an intra-day peak of 1066 in Jun ‘09 and had twice received support from the upper edge of the gap formed in May ‘09.

As long as the gap was not closed, there was hope of further upside. Accordingly, I had made the following recommendation to readers: “Existing holders can stay invested with a stop-loss at 680. New entrants should await a convincing cross above the 1050 mark.” A look at the chart below will show that my advice was timely and appropriate.

Regular readers know that I have a bias against any company with the word ‘Reliance’ in its name. If you don’t know (or remember) why, you can read this post. What is the reason then for posting this update? Well, there are two reasons. The first is to admit to a classic investing mistake. The original post on Reliance Capital in Apr ‘09 was premised on the prospect of likely monetisation of the company’s ‘hidden assets’ – its huge asset management business (Reliance Capital had the highest AUM back then) and its thriving insurance and financial services businesses. The mistake? Hidden assets may stay hidden and never get monetised. (This is particularly true for ‘holding companies’ that hold huge number of shares in different companies.)

The second and more important reason is to warn new investors that though the stock price had more than doubled – from the intra-day low of 225 (Jan 2 ‘12) to an intra-day high of 482 (Feb 22 ‘12) – during the recent rally, the stock is technically still in a bear market and in a down trend. There is no reason to enter now.

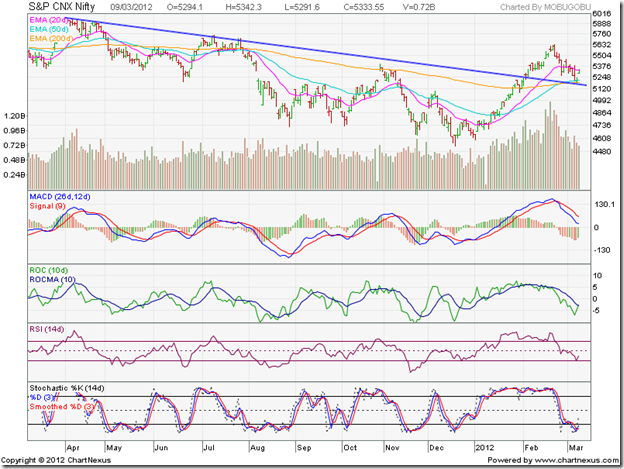

Let us have a look at the three years daily bar chart pattern of Reliance Capital:

The gap in the chart formed in May ‘09 – approximately between 620 and 680 – was filled a year later. That opened up further downsides and triggered the stop-loss of 680 mentioned in the previous update. The stock price bounced up from the lower edge of the gap, and over the next 5 months, gained 40%. But it formed a lower top that marked the beginning of a sharp down trend, which coincided with the bear phase in the broader market.

Note the sideways consolidation between 620 and 680 during Dec ‘10, before a convincing break down below 620 in Jan ‘11. A ‘panic bottom’ formed at 478 in Feb ‘11, following which the stock price bounced up quickly – only to face strong resistance from the earlier support level of 620 in Apr ‘11 and Jul ‘11. This is another example of how a breached resistance level becomes a support level, and a broken support level becomes a resistance level. Another point to note is that support-resistance levels provide better and safer entry-exit points than Fibonacci levels or EMA levels.

The stock price is oscillating near its 200 day EMA. The 50 day EMA is still below the 200 day EMA. The technical indicators are mildly bullish. The MACD is positive and just below its falling signal line. The ROC is also positive and above its 10 day MA, but has turned down. The RSI is a little below its 50% level. The slow stochastic has climbed above its 50% level. The stock price is trying to move up to test the blue down trend line once more, but the falling volumes mean another likely failure of an upward break out attempt.

Bottomline? The stock chart pattern of Reliance Capital is a clear example of disenchantment within the investing community. The recent sharp rally may have provided huge short-term gains to a fortunate few. If you are one of them, book your profits. New investors can look at a company like Sundaram Finance. If you don’t trust the Ambanis, avoid all companies with ‘Reliance’ in its name.

Related post