Rabu, 14 Desember 2011

MF Global

Tipster Trendlines for MT4

If your looking for the MT4 Tipster Trendlines code, go to Steve's site as I'm not posting it at Forex Factory any longer.

www.stevehopwoodforex.com

You have to sign up to be able to download files.

Senin, 04 Juli 2011

Forex Contest

I've already signed up for it, under the name AnotherBrian, account number 28353.

If you want to see where I stand in the league table, here is the link, enter the account number in the search box.

Here's the link to register.

Alpari Forex Contest

Good luck!

Selasa, 28 Juni 2011

Tipster SR

On MTI Live, it was running on Anotherbriandemo, you can see it in the comments of the published statement on the MTI site. It's now running on my real account. I've adjusted the published statement start date of the Anotherbrian MTI Live account to be the same time I started using it. I also use two other trading strategies on this account. ForexMorningTrade and dicretionary trading based on Sam Seiden.

FMT - I use this as more of a scalper with small lot size - this is like a real account test - I didnt back test it. I watch it the day it trades to see if I should close it or not.

Sam Seiden - I usually use a 1 or 4 hour chart for this. This strategy requires patience. In order to help me with that, I found having a robot running kills most of the urge to trade, so I can wait as long as it takes.

So, time will tell.

See the right side bar for performance or visit these links

Demo MTI Account

Live MTI Account

For the longest time I've been breakeven or losing slowly. For the past severla months I've been working on EA's and watching them, and trading myself. I think I found what works for me, as overtrading is a problem. Let's see what happens!! Join the MTI competition for some fun.... it's outlined in the post below.

UPDATE (July3, 2011): The MTI Live website doesn't seem to show things as they really are unless you include ALL history. I haven't figure it out yet (how to correctly show stats from a certain day forward).

The Tipster SR EA is LIVE. It's one of the 3 EA's running on my live account.

Jumat, 29 April 2011

Calling All Robots v2

If you use MT4 (or MT5) and trade forex I invite you to join this free contest. The winner gets bragging rights.

I use MTi to track my performance of both live and demo account. My demo account is running a robot and MTi allows me to see the trade stats. They recently added a new feature called "Competitions". I've started a new competition and I invite you to participate. It's called "Calling All Robots"

To enter you need MT4, and an account with MTi. It's easy to sign up. Once you've signed up you download this and install, it installs automatically. You disable the FTP feature in MT4 options as this new file will upload all the trades to MTi. It's pretty slick.

The competition is scheduled to run from Fri, 27 May 2011 14:08 GMT to Wed, 1 Jan 2020 16:00 GMT

Basically, forever!

Rules The competition is open to both live and demo accounts.

- All accounts must be in USD.

- The maximum size of any individual order is 5.00 lots. Competitors will be disqualified if they place an order larger than this during the competition.

- The maximum volume traded during the competition is 10.00 lots. Competitors will be disqualified if the total volume on trades during the competition is larger than this.

- Competitors must not make deposits or withdrawals during the competition.

- Performance is measured from the first equity figure published by your trading software after the competition starts to the last equity figure published before the competition ends.

- Competitors must publish from the same broker account throughout the competition.

AnotherBrian is my real account.

AnotherBriandemo runs a robots, or robots, on test. Most robots are of my own making.

I also have started another competition, "Perpetual Trading", its for real accounts only and runs for a long, long time.

Rabu, 15 September 2010

BOJ Intervention

Jumat, 27 Agustus 2010

USDJPY

Minggu, 27 Juni 2010

Metatrader Forex Data and back testing

Here is the link to the file - Metatrader Free Forex Data

And the recommended set-up to back test your EA on MT4, follow this link

Set up for back test

There are other helpfull articles on that website also. I took a look at the two systems they are offering for sale and they don't fit my style. I like smooth equity curves. One of the systems has a 30% win rate, I like small gains with high win rates.

Minggu, 18 Oktober 2009

EURUSD

WEEKLY CHART From the weekly chart we can clearly see that price has entered an "air" zone, there is no meaningful resistance on the way up to the top of the yellow box.

Daily Chart - Long History The last time price had to overcome resistance it popped through the orange trend line on the third attempt (yellow circle). Price followed the upward red trend line and is still following it. More on this line later on.... We just broke the blue trend line, and as it happens, on the third attempt just like the prior break. No we are into the yellow free air space.

Daily Chart - Closeup Price just broke through the blue horizontal trend line, on the third attempt, same as the last horizontal trend line break. The pullback after the breakout above the orange horizontal trend line came to the upwards trend line and the 50% retracement. Note that it did not come back to the orange trend line, indicating a strong upward trend following the red line. Keep this in mind when looking to enter on the recent break.

Intraday The yellow area is the S/R "zone" from the weekly chart. It looks like we are clear for now. A good area to place a but LMT order would be at 1.4790 to 1.4844 for a low risk opportunity.

What's next?

Breaking the upward red trend line - This would only mean that the rate of increase or rise in price has slowed. Once it breaks through, look for it to come back to it and test it, then fall. No telling when this line will break.

Pullback - look for a pull back to the upward red trend line or the blue horizontal trend line. The best choice might be whichever one of those area also lines up with a fib level and a round number. I might even load up more on a pull back.

Be patient and wait for the pullback. If you need some help with pull backs watch this Pullback Video.

Do you have a position right now? Are you planning on geting in on this move?

Senin, 12 Oktober 2009

EURUSD

Looks like a false breakout to me. It could also be a shakeout but I dont think a shakeout is that easy in forex and given this is a well watched trandl ine, there are too many participants at this level to do that.

Original Post

I was looking at the EURUSD chart today, deciding how to play pair as it nears long term S/R. My son came into the room and asked me what I was doing. I explained the bar chart and told him that we could make lots of money if our prediction was right. I asked what he thought the chart would do, first taking no more than one minute to show him how prices bounces off previous S/R levels, showing him the trend lines and S/R lines I drew. His 30 second view into the future is attached below and I have to tell you, its as valid as any other.

I'm playing this as a breakout for one reason only, this level has acted as resistance four times already and there is upward pressure from a very long trend line. There are three outcomes I see in the next week or so;

1: Breakout and huge move to the upside because of the long term nature of the two trend lines.

2: Breakout and a failure within a few days, price will move back below the 1.4821 area in a classic 2B move and then tank over multiple weeks if not longer.

3: Price will bounce off this area and head lower, below the uptrend line, then we are moving sideways. until a low is broken.

BTW - I have used Tipster Trendlines to place my trades. Check out this AFL for Amibroker for placing error free trades. "Error free" refers to the task of placing the trade, it does NOT refer to a trading system. the AFL also offers a risk management tool.

In short - this is a great place to watch price and place a trade. In other words, don't waste your time trading in between S/R lines on your chosen time frame.

Not sure about the long term, I'm focusing on the weeks ahead. Just for kicks, I'm posting what a 9 year old boy thinks of this market.

Minggu, 06 September 2009

Forex Volume

Forex data can be derived from tick data. I use this right now, the number of price changes from the IB data stream is counted and added until the bar closes, the afl uses the ibc.getrealtimedata function.

You could also use forex futures volume data, Amibroker will let you do this easily, but the market hours aren't the same from what I understand. I've never looked into this, so don't consider this as fact.

I ran across a site where forex futures data is taken from the CME website reports that are posted and available via ftp. The website is call evolution. I read some post at forex factory and it seems the site has been up for a couple of years. There doesn't seem to be a huge following, (which is good if you ask me).

I'll be taking a closer look at the max volume levels for the past week and keep an eye on them. Use this with your support and resistance and we will probably find more clues to where the next bounce will happen.

Take a look and leave a comment here on the site, as well as your thoughts on forex volume.

Selasa, 02 Juni 2009

USDCAD - Trade update

Kamis, 21 Mei 2009

USDCAD - Look out below!

Credit Crisis and PUT option

If you do some creative searching on Google, you will find that there were those that shorted the market using PUT options before the credit crisis was public. Click on the link above to get started. So here is what I'm saying, you might have noticed this happening, and allot of traders did. How many acted? Notice the forum article, the writer is trying to figure out why? Who gives a rats ass why. Keep that in the back of your mind, like a dart in your back pocket, take it out when you need it. If you saw the market take a shit kicking like it did on November 8, 2008, you might have thought to wait a few days for a bounce, and pick up some PUTs. Or, you might have not because you wanted to know WHY? and didn't make a killing like the traders who sunk billions into PUTs. So, why ask why?

Here are the charts. Notice the daily support level at 1.1463 TO 1.1350.

Sabtu, 28 Maret 2009

USDCAD Poll

Breakthrough

I haven't been working a whole lot on the updated version of Tipster Trendlines but it is close. I sent the code to a reader (David) who is testing it. David had some good ideas to improve the flexibility of the code. For example, the ability to submit a bracket order, or just a buy/sell order, or a buy/sell with a stop. Also, the menu's have changed with everything on a single pane.

Since the beginning of the year I thought I'd concentrate more on actually trading than coding trading systems reading/writing blog posts, and actually gain more experience trading every day.

Also over the past few months my frustration with IB's data feed has grown so I decided to try another broker for forex trading while still not closing the IB account. My issue here is that you cant get tick data. If I use another feed to Amibroker and IB to trade forex the two may not jive enough to scalp and/or place my stops. So I think we are kind of stuck with IB's crappy data feed.

I've opened a new account with MFGlobalFX to trade forex. I think they are an affiliate of FXCM since I can log onto the dailyFX website for news and signals (more on that later).

Their simple little platform is really all I need, I found to my surprise. I plot a few MA's and display a daily, H4, H1, M1, and tick chart to trade. Once I figured out what I wanted to see and what indy's I wanted to on my screen, trading was more simplistic. I only use price, MA's, slow Stochastic, and a table of ATR values. The platform is FXTradingStation by CandleWorks, does anyone else use this? The indicators are written in a language called LUA. I'm not about to dive into another language to port some indicators. So back it is to Amibroker. How do I get this new brokers data into Amibroker? ... more on that later....

Using this little platform made me think a little after I has some successful trades. Amibroker allows us to over complicate things. This simplistic approach helped me get my head around the trading plan that I needed to simplify. My plan was more than 10 pages and I really wanted a 2 pager, something I would memorise without even knowing it, something short. Also during that time I listened to a TraderInterview. This particular trader made up a simple "table", I call it a matrix, of his set-ups. He would detail the set-up for the applicable time frame and how to initiate a trade and possible profit targets. It is well known that a trader needs a few set-ups to draw from in order to flatten the equity curve, and this is a good visual tool to do that. This trader also scored the set-ups for each trade, promoting good set-ups and "firing" the under performers. Promoting just refers to increasing position size for the set-up. So this was my road map to simply my trade plan and my charts.

Sabtu, 24 Januari 2009

Currency Interest Rates

Many brokers will credit or debit your account on overnight forex positions.

Interest is calculated using the difference between the two currency interest rates. For example if you trade Euro Dollar, the ECB (European Central Bank) and FED (Federal Reserve) are the banks you would need to look too for the current rates.. If the ECB's rate is 2.25% and FED's rate is 4.25% the difference is -2%. A long (buy) position on Euro Dollar will generate a 2% debit interest on your account, a short position will generate a credit interest of 2%.

To show you the impact of this, here are a few examples and a link to use this currency interest rate tool. This is also know as the carry trade.

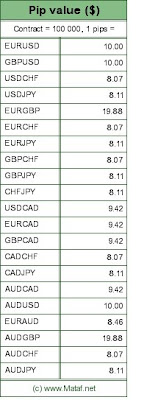

You need to know what will have an impact on your trade, and what the impact will be in order to make an informed decision. Using the chart below yo can see that the interest is minimal for most small trades, but of coarse this depends on the pairs, the rates, and the length of time you are holding the trade open.

Jumat, 16 Januari 2009

USDCAD

Senin, 08 Desember 2008

USDCAD

Interesting chart pattern on the USDCAD. Triple top with an ascending wedge. A triple top gives it a bearish feel but the pattern is not valid until it breaks lower support. The ascending wedge gives it a bullish overtone. Since we don't have volume to add to the clues, we can only use price action. Notice the buyers were not waiting to buy shown by the lower lows. Also the lower lows get closer together, so they are also not waiting as long to jump in. On the other hand, look how fast price jumped off the top resistance line, telling us all kinds of sellers came in, plus its a big super fat round number (1.3000).

Buy on a break over 1.3 with tight stops, it either goes like a f'n canon, or fakes out and reverses back into the channel.

On a break out, you could also put in a short stop order below the 1.3000 line to catch the fake out on its way back to the bottom of the channel.

This is the type of pattern I would use breakkouts on, not channel trading. The converting to USD might be over, then again it might not. Use price action to guide you. Don't enter at the middle of the channel, enter at the top or bottom, this allows you to use tight stops, control risk, and have an edge.

Rabu, 04 Juni 2008

New Links

Delayed Entry

Using Fibs to enter

Multiple Targets

Re-Tests: Resistance Becomes Support

Senin, 31 Maret 2008

Correlation and Sentiment

The chart is the last one in the post. This correlation table supposedly update with time as it is a link, not an image.