The previous update of the stock chart pattern of Hero Honda was posted back in Nov ‘09. The stock was a sterling performer during the bear market – moving up from 630 in Jul ‘08 to 1100 in Mar ‘09 – while the Sensex and most other stocks were hitting their 52 week lows.

The strong performance continued for another year - right up to Apr ‘10 – when the stock price crossed the 2000 level and closed at 2057 (marked as T1) in the week ending Apr 9 ‘10. A gain of 225% from its Jul ‘08 low.

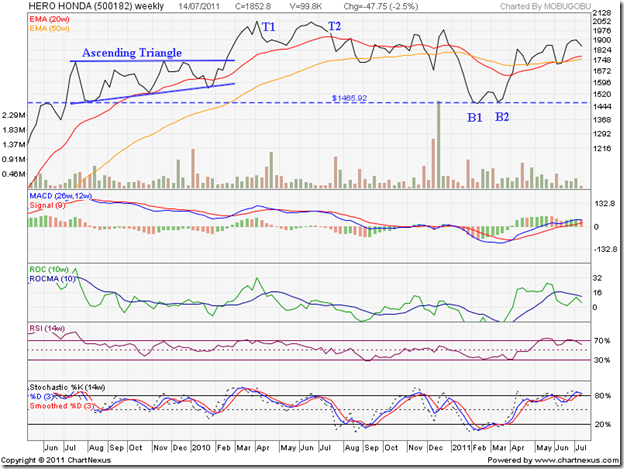

Let us look at the two years weekly closing chart pattern of Hero Honda and find out what happened after that excellent up move:

During Jun ‘09, the 1465 level had provided good resistance to the up move. Once the stock broke the resistance in Jul ‘09, it quickly reached a new closing high of 1736 in the week ending Jul 24 ‘09.

The subsequent correction found support from the previous resistance level of 1465 – another instance of a resistance turning into a support. Volumes were quite strong during the resistance and support.

A 7 months long consolidation followed within a bullish ‘ascending triangle’ pattern, from which the expected upward break out occurred in Feb ‘10. Note the volume bars in Feb ‘10 – they should have been substantially higher to technically validate the upward break out. That was the first warning about an impending correction or reversal.

Though the stock price rose sharply to close at 2057 in Apr ‘10, the MACD, ROC and RSI reached lower tops and the slow stochastic just managed to reach its previous top. The combined negative divergences of all four technical indicators was the second warning about a possible correction/reversal.

The stock price corrected down to 1858 in the week ending May 21 ‘10, only to rise to 2050 (marked as T2) in the week ending Jun 25 ‘10 – falling short of the Apr ‘10 top of 2057. The lower volumes during the Jun ‘10 top opened the door for a bearish ‘double-top’ reversal pattern. That was the third warning about a correction/reversal.

The stock price crashed through the 20 week EMA in Jul ‘10 and dropped below 1858 (the May ‘10 low), which confirmed the ‘double-top’ reversal pattern. The stock price consolidated sideways till Dec ‘10. There was a sharp drop below the 50 week EMA (equivalent to the 200 day EMA on daily charts) to 1679 on strong volumes, followed by an equally sharp 300 points spike to 1986 on higher volumes.

That seemed to exhaust the bullish fervour. The rumours about Japan’s Honda Motors pulling out of the joint venture with the Munjals of Hero group were confirmed. The stock price fell more than 500 points to the support level of 1465 in Feb ‘11. The 20 week EMA crossed below the 50 week EMA – the dreaded ‘death cross’ that confirmed a bear market.

But you just can’t keep a good stock down for long. A bullish double-bottom pattern (marked as B1 and B2) formed in Mar ‘11, and the stock recovered quickly above both the EMAs in Apr ‘11. It has been trying to move up for the past two months, but without much success. The low volumes haven’t helped. But the 50 week EMA has provided good support, and the 20 week EMA has crossed above the 50 week EMA.

The technical indicators are weakening. The MACD is above the signal line, but the upward momentum is slowing. The ROC is still positive, but has dropped below its 10 week MA and touched a lower top. The RSI has dropped below its overbought zone. The slow stochastic is threatening to do likewise. Another test of support from the 50 week EMA is likely.

The company is fundamentally very strong, with strong operating cash flows, negligible debt, huge reserves, a regular dividend payer and the leader in the two-wheeler segment. The uncertainty about future technology inputs and entry of Honda in the two-wheelers segment are the negative overhangs.

Bottomline? The stock chart pattern of Hero Honda shows that technically the worst may be over. Some fundamental concerns remain. The main competitor, Bajaj Auto, is di’worse’ifying into four wheelers. That could be just the opportunity for Hero Honda to consolidate its leadership position. Investors can use dips to accumulate.