The US economy is slowly recovering from a massive downturn. To boost growth, interest rates have been maintained at near zero levels. Despite two rounds of Quantitative Easing, growth hasn’t picked up as expected. So, inflation has also remained low.

India has the opposite problem. High inflation has been fuelled by strong growth. To contain inflation, interest rates have been increased. But the inflation adjusted fixed income returns are negligible in both countries. In this month’s guest post, KKP gives his views on how to truly get rich by boosting your inflation-adjusted returns.

-----------------------------------------------------------------------------------

Feel Rich Only with ‘Real’ Inflation-Adjusted Net-Worth-Growth

The 8th wonder of the world is ‘% rate compounding’. In simple terms it means that growth in money based on money-making-money. In the US schools, I have taught kids how to become a millionaire by starting a part-time job at age 16 and putting $100 per month into an interest bearing account that multiplies money over the next 20-40 years of their life. On a side note, it is very interesting how many millionaires there are in the US, and in general, their profiles/habits/investment-styles (Google search for this info).

Well, the same effect of compounding works against us when it comes to inflation. In mainstream economics, the word ‘inflation’ refers to a general rise in prices measured against a standard level of purchasing power. Previously the term was used to refer to an increase in the money supply, which is now referred to as expansionary monetary policy or monetary inflation. Inflation is measured by comparing two sets of goods/services at two different points in time, and computing the increase in cost not reflected by an increase/decrease in quality. This is something that emerging economies grapple with during their entire growth phase, and we call that ‘growth pains’.

The inflation rate in India was last reported at 10.1% in Sep 2011. From 1969 until 2011, the average inflation rate in India was 7.99% reaching an historical high of 34.68% in Sep 1974 and a record low of -11.31% in May 1976 (strange but reported as negative). Many banks in India are offering 9% to 10% FD rates today, with corporate FDs getting much higher rates (at higher risk levels). Well, that is just a net 1% to 2% rate of return (after inflation). The chart below shows fluctuations in inflation within our Indian (a.k.a emerging) economy over the past three years. So, money is growing at a net-rate of only 1% to 2% in FDs or FMPs.

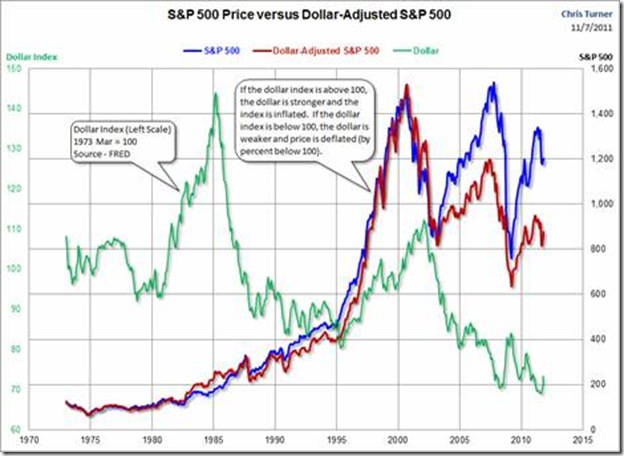

The US is about to move from a highly controlled non-inflationary environment into a high-inflation environment due to the non-stop printing of treasury bonds (no gold collateral is needed as everyone knows). Inflation basically makes you shell out more dollars to buy the same product (same quality and quantity assumed). So, one needs to earn more as a result - just to keep up with the inflation. Now, what really happens with inflation is a reduction in the value of the currency. So, as an example, one needs more dollars to buy an asset like a home, a gold coin or gallon of milk. See the chart below and study it for a couple minutes. Has the S&P500 really grown even though our Mutual Fund account might be showing net-growth-in-value? Maybe, slightly!

On the other hand, companies pay employees more every year to keep up with the inflationary environment, and over a period of time everyone feels good that they were earning $24,000 per year in 1996 or 2001, and now, they are earning $50,000 per year. But, when you measure it in terms of the depreciation in the dollar (caused by inflation), are they really better off with the higher salary? Or, would they rather have a no-inflation environment and get paid slightly more for their growth in experience and skills?

So, compounding effects of inflation in every economy around the world is really killing the value of the underlying savings that we hold, unless we keep growing that money ABOVE the inflation rate on a consistent basis. So, in India, if one had Rs 10 Lakhs in 2001, and now has Rs 21.58 Lakhs, then at the average inflation rate of 8% per year, their net-growth in wealth is a BIG ZERO. Same zero growth applies if one had Rs 1 Crore in 2001 and now has Rs 2.158 Crores. Yet, all of us feel good about the growth in the ‘total raw value of our accounts’.

Emerging economies give a lot of people a false sense of security that they have grown their income or assets by a huge amount over time, but one needs to beware of the 8th wonder of the world working in ‘reverse’. India is going to generate the largest population of ‘middle income earners’, but one has to consider what a ‘real middle income level’ is, as inflation rate is eating away a lot of the increased income. As a result of the growth in the underlying Indian economy, a lot of low income earners will start feeling like middle-income-families, but for many it is a false sense of hope and feeling. Beware and generate a Return on Investment (ROI) way above inflation through a mixture of Stocks, Bonds, Real Estate, Commodities, FMPs and FDs.……That is the only way to feel rich and get truly rich!

-----------------------------------------------------------------------------------

KKP (Kiran Patel) is a long time investor in the US, investing in US, Indian and Chinese markets for the last 25 years. Investing is a passion, and most recently he has ventured into real estate in the US and also a bit in India. Running user groups, teaching kids at local high school, moderating a group in the US and running Investment Clubs are his current hobbies. He also works full time for a Fortune 100 corporation.