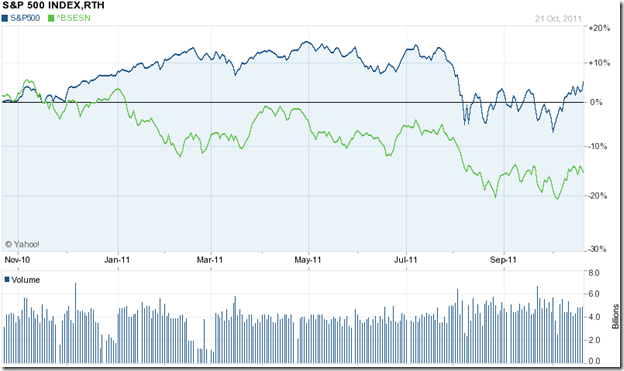

What a difference a day’s trading can make! The break out from the 12 weeks long rectangular trading ranges on the BSE Sensex and NSE Nifty 50 index charts not only happened on the upside against bearish expectations, but has opened up the possibility of a trend reversal.

BSE Sensex index chart

The Bullish view: The trading on Fri. Oct 28 ‘11 started with a huge upward gap between the 17300 and 17600 levels. The gap coincided with the big downward gap on the Sensex chart formed during the break below the descending triangle pattern in Aug ‘11. The gap area has been marked with a pair of blue parallel lines.

The entire trading below the gap has formed an ‘island’ of trading, opening the door for a bullish ‘island reversal’ pattern that can mark the end of the year long bearish phase, during which the Sensex corrected by 25% (more than 5000 points) from its Nov ‘10 peak. The ‘island reversal’ pattern will be confirmed only if the gap area remains unfilled (or gets partly filled).

Unless the Sensex convincingly breaks out above the blue down trend line on strong volumes and continues with the rally, there is every possibility that the resistance from the down trend line proves too strong (as has happened three times before), and the Sensex falls again to fill the gap. In the latter case, the bear phase will continue till it gets reversed at a later date.

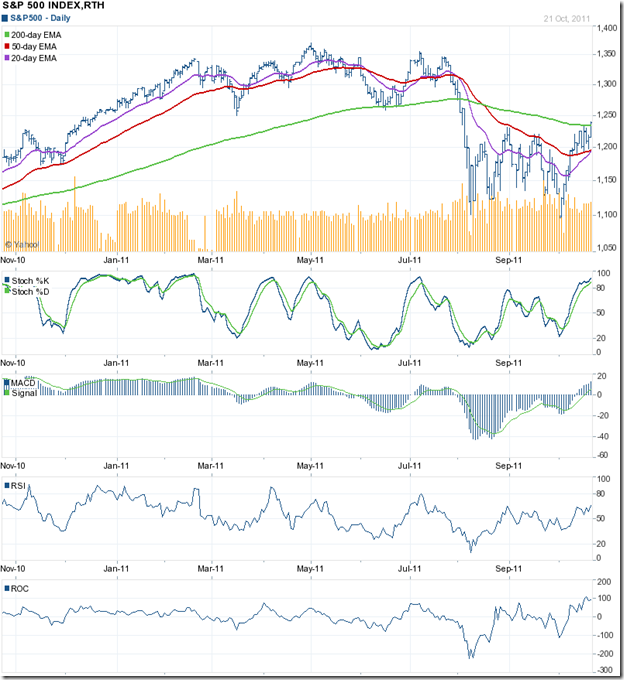

The technical indicators are looking bullish. The MACD is rising above its signal line in positive territory. The ROC is also positive, and above its 10 day MA, but has touched a lower top. The RSI and the slow stochastic are both inside their overbought zones. That could mean a correction round the corner.

NSE Nifty 50 index chart

The Bearish view: A strong upward weekly bar on the Nifty chart has re-entered the large descending triangle and closed above the 50 week EMA for the first time in 14 weeks. Such strong weekly up moves have happened several times before, but the blue down trend line has resisted all previous rallies during the past year. Till the down trend line is convincingly breached, the trend will remain down.

The technical indicators are showing signs of bullishness. The MACD has crossed above its signal line, but remains deep inside negative territory. The ROC has moved sharply above its 10 week MA into positive territory, but such sharp up moves usually don’t sustain. Both the RSI and the slow stochastic are moving up, but are below their 50% levels. Any attempt to climb above the down trend line is likely to attract selling.

Despite another interest rate hike by the RBI, inflation continued on its upward trajectory. Without strong fiscal policies from the government, RBI’s monetary tightening has hurt growth but failed to curb inflation. Even if RBI pauses its rate hike, that doesn’t mean interest rates will be lowered right away. Stock markets don’t flourish during times of high interest rates. The situation in India is quite different from that in the US and the Eurozone, where stock markets are in bull territory mainly because of zero or negligible interest rates.

Bottomline? The BSE Sensex and the Nifty 50 index chart patterns have broken out upwards from their 12 weeks long trading ranges. But trend reversals are yet to be confirmed technically. Eurozone’s debt problems have been temporarily solved through write-downs and bail-outs. Growth slow down in India caused by high interest rate is not conducive for a bull market. Time to be cautiously optimistic – not bullish.