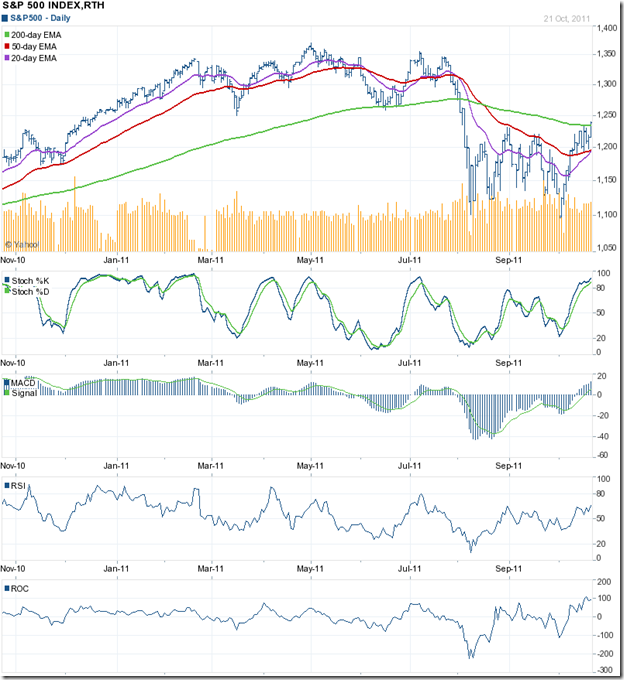

S&P 500 Index Chart

Last week, the technical indicators of the S&P 500 index chart were pointing to a continuation of the rally. The rally, supported by decent volumes, led to the highest close since Aug 2 ‘11, and a close above the 200 day EMA.

The 20 day EMA is about to cross above the 50 day EMA, and all four technical indicators are looking bullish. Have the bears been vanquished? It appears so, but there are a couple of warning signs for the bulls. Both the RSI and the ROC failed to reach new highs with the index. The negative divergences may stall the rally.

Decent corporate Q3 results, and the possibility of a resolution of the Eurozone debt problems are probable causes of the rally. End of the financial year considerations may also be behind the buying. If the bail-out plan in Europe doesn’t work out, global markets may face a lot of selling.

US economic indicators are hardly encouraging. Housing starts rose by 15%, but new building permits fell 5% in Sep ‘11. Weekly unemployment claims dropped to 403,000 but remained above 400,000. ECRI’s WLI growth indicator dropped further to –10.1 from –9.7 a week earlier.

FTSE 100 Index Chart

The FTSE 100 index formed a ‘reversal day’ pattern (higher high, lower close) on Mon. Oct 17 ‘11. The index consolidated sideways for the rest of the week, receiving good support from the 50 day EMA before closing a bit higher on a weekly basis.

The technical indicators are looking bullish, and the index may move up to test resistance from the 200 day EMA. Further continuation of the rally will depend on an early resolution of the Eurozone debt crisis.

UK retail sales picked up 0.6% YoY in Sep ‘11, but were down –0.2% for the Jul-Sep quarter. Manufacturing output fell 0.3% in Aug ‘11. Public sector job losses are now more than private sector job gains. The possibility of a double-dip recession can’t be ruled out.

Bottomline? The chart patterns of the S&P 500 and FTSE 100 indices continued their surprisingly strong rallies that are threatening to break the strangleholds of the bears. A satisfactory resolution of the Eurozone debt crisis has already been discounted by the markets. Any disappointments on the debt relief front may trigger off widespread selling. Better to be cautiously optimistic, instead of being brave.