The Indian markets are on a tear once again, as the FIIs have renewed their buying after a few months of profit booking. What caused the turnaround? Is it the realisation that the US and European economies are growing a lot slower than expected earlier?

In this month’s guest post, KKP takes a look at the US housing market, and points out that while there are signs of improvement, it may take quite a while before normalcy returns. KKP is a very busy person, wearing multiple hats. Yet he still finds time to write these monthly posts to enlighten this blog’s readers about the real state of the US economy.

------------------------------------------------------------------------------------------------------------

Current State of the Economy and the Housing Market

Guys, as I have been writing about the state of the US economy, there are many things that surprise me and others that just go ho-hum as expected. For example, the housing data for the fourth quarter of 2010 as released in Feb 2011 indicate that the recovery in the housing market continues to remain fragile. In the production sector, single-family housing permits increased and new housing starts remained steady, although completions fell. Multifamily housing permits (i.e. apartment buildings), starts, and completions all fell, although permits and completions were down only slightly.

This really means that overall, the existing resale of real estate as well as new constructions were down in the 4th quarter. As a result, inventories of available homes at the current sales rate decreased in the fourth quarter of 2010, reaching an average rate of 8.0 months’ supply of new homes and 9.4 months’ supply of existing homes, down from rates of 8.5 and 11.7 months’ supply, respectively, in the previous quarter. This seems like contradictory data, but it is really still a soft market. Here is a graphical representation from the CSI for Chicago:

As we started March 2011, I continued the zeal to own more real estate, and my searches have led to too much competition from other buyers like me who are snapping up ‘deals’. When I say ‘deals’, this means housing that is at the low end of the market for any sub-division or area. This means that ‘bargain hunters’ like me are tracking these houses and apartment building and bidding on those. When a home comes on the market, within a week or so there are multiple buyers, who then go into Best and Final Offers, and then the highest price wins. The above is not in the ‘auction market’. In the auction market higher prices are bound to happen since the auctioneer creates this type of a competitive environment, collects all the buyers, and sets a time-line of when someone can bid on homes. I have used ‘auctions’ to my advantage to put a competitive bid on the table for a home being sold by a broker versus an auction bid in progress for a home on the same street.

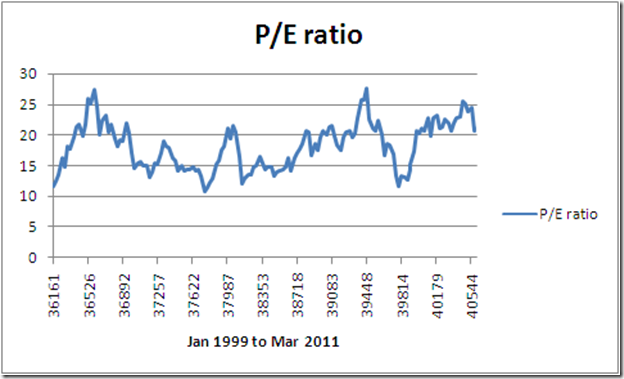

Home pricing across the US is still soft, as depicted by the two graphs below. It will take some time for the tide to rise again, although all of it depends on how the overall economy performs, and how job growth fares.

My most recent home purchase was a contract that we finalized on Dec 21st, 2010, that finally came to a conclusion this week (March’2011)…..3 months to come to a conclusion is normal these days, and this one was purchased in a bid, although not an auction. It takes a lot of courage to put hard earned money to work, but when we get a deal for 29.723 cents to the dollar, it was hard to refuse for a 4 bedroom, 2 bathroom, 2 kitchen, and 1 car garage property (basically 2 flats in one building). You might ask, why do you think it was being given away? Because these are homes where the owner cannot pay the mortgage for more than 1 year, and it was time for the Bank to own it and then the Sheriff to come and get the home evacuated. We will do some fixing up to make it pretty and upgrade a few things and rent it out. That is a successful model with a high ROI (Return on Investment) on the investment from the rents. ROIs in property investments of this kind range from 12% to 26% on the investment today, without accounting for any capital gains on the property when we eventually sell it.

Mortgage rates are slowly coming down due to soft demand, but we are still looking at 5½% to 6% borrowing rate on any home loans with people who have a decent job. If one does not have a decent job, or no job at all, it is impossible to get a mortgage from a bank, which means that their intent to buy the house is only a dream. Too many people fall into the latter category, which is why the rental market is really hot relative to buying.

Hostels/Dormitories where kids have to live while they are in college are also raising their prices simply due to demand at Universities, but also because, rents are going up. Well, an alternative that a parent has to getting a kid into a hostel is to buy a condo/apartment/flat near the university and allow their kids to stay in it. This is my plan for my kids, although it takes time to pull off a strategy of this kind. Many parents are trying based on my research and findings. This again must be due to the fact that condos have gotten cheaper and dormitory fees have gotten higher ($11,000 per year per child for 8 months of University studies which consists of 2 semesters).

Jobs on the other hand are very selective and almost a privilege to have, and hence everyone is working their tail off to keep their job, and advance in their career. Corporations are optimizing their resources heavily while putting a ton of automation into their business processes to eliminate heads. This steady reduction in work-force and the doldrums in the economy are going to continue to put a lid on real estate market (ownership), whereas it is going to keep the rental market alive and well for 2 to 5 years (minimum). I do see the real estate market starting to turn in 2-5 years (by 2015) assuming that we do not get any effects like Japan in the US, or economies like Japan does not affect the overall US economy or US dollar.

Technologies that make the US economy more efficient are being implemented by corporations with video conferencing, Voice over IP, variety of portals, automated scripting, cloud computing, Web 2.0, alternative energy, Pads of all kinds, mobile platform (along with automation) etc making our world simpler/faster/better. This is bringing some stability to the people who are part of the leading edge technologies (sales, implementations and operations). Service industries that serve the running of the economy are also surviving, but if the business model is weak, then those are getting weaker day by day, and the weaker ones are tumbling. This is keeping the unemployment at the published 9-10% levels, although who knows what the real number is below the surface.

We shall see what 2011-12 brings with it…..Once again, if one has a good job and is keeping up with the changes, then this economy is soft or in recession. If one is not keeping up with the technological changes, then this is a recessionary environment for them, but if one has lost their job, it definitely feels like a depression.

In the meantime, enjoy the super-bull-market of India – everything has a cycle, so just as the pundits say, things do not grow to the sky, and everything that goes up has to come down. So, capitalize while you can, since everything does not stay green all the time!!!!!! Please put views from your rose coloured glasses on the blog as usual….

------------------------------------------------------------------------------------------------------------

KKP (Kiran Patel) is a long time investor in the US, investing in US, Indian and Chinese markets for the last 25 years. Investing is a passion, and most recently he has ventured into real estate in the US and also a bit in India. Running user groups, teaching kids at local high school, moderating a group in the US and running Investment Clubs are his current hobbies. He also works full time for a Fortune 100 corporation.

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgC3_L6_3ucuZ5yfj57ibiCSpUkYUr61FWdU6_WjoWi6wwVb6vcMPzE2Hph13i_7tfMyHVvOf3gkeoa02m8DkXc7z0S1vz2XcqMKaKRDArqEKmJctsGbk2Mm5GmWR1Ktsl5g9AaPojHOTc/?imgmax=800)

![clip_image002[6] clip_image002[6]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjcwKweyg6sZcDyAgbgmUJ9PGPvaSlL1eXY0QnAzDgEGgGhyphenhyphen62isq433WyYDcBtZ89OaOvyQnNlLp19JWFkNm8vaN9irZo9r6zG1gmeEzWjnmiqfftfaCAhBMp6E9eQLQ-bf04O0BrWnPQ/?imgmax=800)

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg8Aj1ZniLLq1-iXKCSGyhcl_2Zj-kcn0ueOfn38MOZ-SJzYJcJXJfz20Bor1IXkUx6_ad5yp5oP5l9rpDxo22z_kTIyhmS5I2CNwi0L89ztq1rerZNt6emW0Rd4WbRMi06226BgLC1kRk/?imgmax=800)