Indian investors have been worried about why the FIIs are pulling out of emerging markets and redeploying in developed markets. Some say that the relative valuation difference between emerging markets and developed markets is the real cause. Others are of the opinion that this is not a flight of capital but routine profit booking. There is another school of thought: the turmoil in North Africa and the Middle East has pushed up oil prices and made emerging markets riskier.

There is no doubt that FII selling in emerging markets has affected the Indian stock market indices. The series of scams – be it the inflated costs for the Commonwealth Games, or the telecom 2G spectrum allocation, or the various scams involving real estate development – seems to have shaken the confidence of the FIIs. The rising inflation rate, leading to a steady rise in interest rates, has increased the cost of doing business.

When and how will this situation get turned around? Politicians, government officials and the real estate mafia are not going to turn into honest and law abiding citizens overnight. Nor can inflation be curtailed by pressing a button. Who knows where the Middle East turmoil will be heading? In other words, the uncertainty overhang can not be wished away. And stock markets hate uncertainty.

Is the current fall in the Sensex and Nifty 50 a good buying opportunity? Will prices become even more attractive if one waits? How can an ordinary small investor decide what to do in uncertain circumstances? When fundamental analysis can’t provide clear answers, one has to look elsewhere.

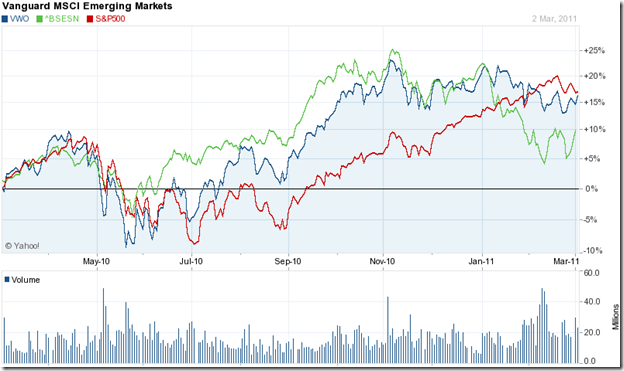

Given below are the one year closing charts (in blue) of two Emerging Market ETFs traded in the US market – the iShares MSCI Emerging Index ETF (EEM) and the Vanguard MSCI Emerging Markets ETF (VWO). Superimposed on the two charts are the BSE Sensex chart (in green) and the S&P 500 chart (in red):

Since both the EEM and VWO ETFs track the MSCI index, their chart patterns are similar. The BSE Sensex was the clear outperformer during the period Jun – Nov ‘10. EEM and VWO ETFs caught up and outperformed the Sensex during Jan – Feb ‘11, even as they corrected down. Percentage profit booking in the Indian indices exceeded the selling in the MSCI emerging markets index.

During Feb ‘11, the S&P 500 has been the outperformer, but the gaps between the S&P 500 and the two emerging market ETFs are reducing. It is interesting to observe that the recent rallies in EEM, VWO and the Sensex have coincided with profit booking in the S&P 500.

Indian investors would do well to track the EEM and VWO ETFs for signs of FII investments returning back to emerging markets. Without FII buying support, the Indian markets are not going to move up any time soon.