Since hitting a peak in Nov ‘10, the Nifty has been in a corrective mode for 4 months. The correction began when the Nifty came near its earlier all-time high touched in Jan ‘08. What initially seemed like a routine bull market correction, turned into a more serious correction due to the unrest in North Africa and the Middle East that sent oil prices above the three figure mark.

The index dropped 18% from its peak before recovering somewhat, and has been trading within a range of 5200 - 5600 for the past 5 weeks. The FIIs have been net sellers during 2011, pulling out $2 Billion to redeploy in their home markets. Relative valuations of developed market indices like the S&P 500 and the FTSE 100 were more attractive. Of late, they seem to be buying again, as the overseas markets are correcting.

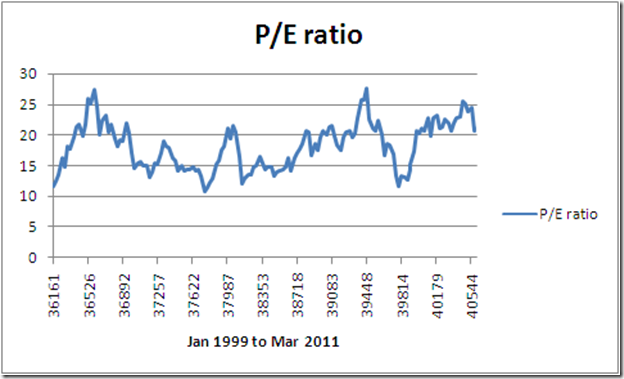

What should investors do? Is the Nifty undervalued after the correction, making it a good opportunity to buy? Or is it still overvalued despite the correction? The best way to find out is to look at Nifty’s monthly P/E ratio chart, drawn for the period Jan ‘99 to Mar ‘11:

Nifty’s P/E ratio has varied between 11 and 27 during the past 12 years - with peaks of 27.35 on Mar 1, 2000 and 27.64 on Jan 1 2008, and troughs of 11.62 on Jan 1, 1999; 10.86 on May 2, 2003 and 11.76 on Dec 1, 2008. The average P/E ratio over the past 12 years is 18.24.

Leaving the peaks and troughs aside, as it is next to impossible to catch the exact tops and bottoms, we can reasonably assume that P/E ratios between 15 and 21 is the ‘hold’ range. In other words, only stock specific buying should be done when the Nifty P/E ratio is between 15 and 21. Any drop below 15 is the across-the-board ‘buy’ zone and any move above 21 is a ‘sell’ signal. Patient, long-term investors can use these levels to decide entry and exit points for almost assured returns.

The Nifty traded at or below 15 P/E continuously between Aug ‘02 – Aug ‘03, providing the ‘mother of all buying opportunities’ in the past 12 years. It also traded continuously below 15 P/E between Jun ‘04 – Nov ‘04, Feb ‘05 – Sep ‘05, and Nov ‘08 – Apr ‘09. The market does provide great buying opportunities, if only investors would learn to wait for them.

On the other hand, between Dec 1 ‘09 – Jan 3 ‘11, the Nifty continuously traded at or above 21 P/E – giving excellent selling opportunities to those who may have bought earlier. Nifty’s P/E ratio on Mar 1 ‘11 was 21.04. So, it has only dropped to the outer edge of the ‘hold’ range – in spite of the four months long correction.

Since the Nifty is trading above its average P/E ratio of 18, it is still ‘overvalued’. That is one of the reasons why FII money is flowing out.