The data flowing out of the US economic indicators have been showing definite signs of recovery from the world-may-come-to-an-end kind of scenario three years ago. Two large doses of Quantitative Easing have prevented a collapse of the financial system. The stock market is soaring and corporate America is flush with cash. Unemployment situation is improving and even the moribund housing market is beginning to show signs of life.

Is this the proverbial light at the end of the tunnel, or is it the headlight of an onrushing train? In this month’s guest post, KKP expresses his apprehensions about the strength and durability of the US economic recovery. He also presents a positive outlook from a recent consumer survey report.

-------------------------------------------------------------------------------------------------------------

Beautiful Orange Sky Before Darkness

The sky looks awesome right now since it is 6 pm and we can see the sun setting on the horizon. It is a perfect time when the glare of the sun does not bother our eyes, the heat has reduced to a more comfortable level, and it is all-in-all pleasant to everyone enjoying this moment. The key is to know what happens in a few minutes to an hour. It will be dark and the lights need to turn on. Oh no, the electricity man came earlier and cut off our electricity? Is that possible? Turning to my wife, I ask if we paid the electric bill on time? Huh!

Well, it seems that we are facing such an evening right now in the global economy. The bearish blog writers have portrayed well that ‘patch-work’ solutions of the current debt-related issues are only going to take us so far. One fine day the electricity guy is not going to take our cheques (or bonds) and the darkness is not going to get illuminated with a 100 or 200 watt CFL (tube light) bulb.

Many global economies are running on borrowed time, with times of pleasure and growth in between based on government maneuvering for political reasons. Is the booster shot that Greece just got something that will last, or will it need a 2nd, 3rd, and 4th shots before the antibiotics kick-in? And will the patient be alive when those 3rd and 4th shots are given? Are the other countries after Greece in the PIIGS acronym next to ask for rescue packages? Of course, they are almost ready now. We already have a next acronym after PIIGS and it is CAASH. This is the Canadian, Australian, Hong Kong and other economies that also have their Debt-to-GDP ratios going out of whack. US tax collections are lower than ever, and annual deficits are in the same range as during 1929-1934 (% of GDP). Are we so information overloaded that we cannot see the turmoil in the air, or are we too busy with our daily chores, ‘synch’ing our mobile devices, and playing Angry-Birds on our Tablets/iPhones/Androids?

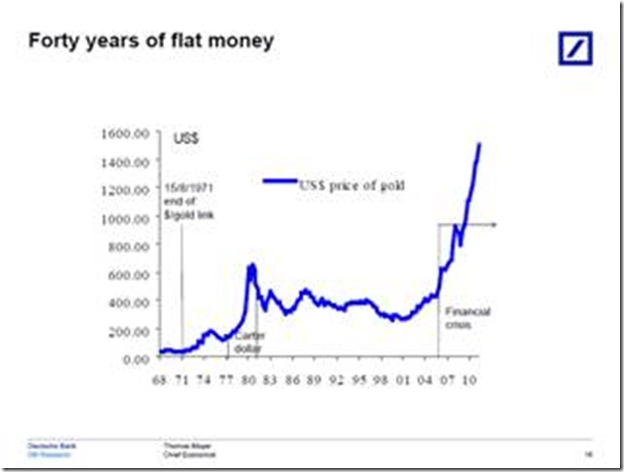

Take a look at the previous crisis and what happened to Gold. Look at what has happened to Gold even without a ‘real crisis’. I say that the crisis has not happened since we keep averting the ‘root cause’ event with patch-work. In the meantime, we have high tides and low tides in the market and have the emotional roll-coaster associated with it (being left out, or what did I do!). So, let’s watch what is happening in the global markets and react accordingly.

If you want to see a positive viewpoint of the most current survey that I participate in with ChangeWave, here is partial report. Of course, I was not very optimistic in my input to the survey. We are approx 5000 to 10000 people in this closed group of professionals that provide our input based on our consumer spending or enterprise spending surveys. It will show the minor waves of positive and negativity, and of course, it is showing the positive/optimistic living that we are all experiencing right now. I am all for good living, and benefitting from positive waves, but will it last?

-------------------------------------------------------------------------------------------------------------

February U.S. Consumer Spending Report

Spending Accelerates for February as Consumer Confidence and Expectations Improve

by Jean Crumrine and Paul Carton

Overview: In a clear sign of accelerating momentum, U.S. consumer spending has soared in February – the second major upswing of the past three months. Importantly, the February 1-13 ChangeWave survey shows overall spending at a nine month high, and confidence and expectations continuing to improve. ChangeWave Research is a service of 451 Research.

The survey of 2,501 U.S. consumers finds the biggest spending upticks are occurring in Travel/Vacation, Household Repairs and Improvements, Autos, and Restaurants.

Moreover after last month’s post-holiday declines, our latest findings point to renewed momentum for several retailers, including Costco (COST), Target (TGT) and Walmart (WMT).

Consumer Spending Outlook: Three-in-ten U.S. respondents (30%) now say they'll spend more over the next 90 days than they did a year ago – up 6-pts since our previous ChangeWave survey in January. Only 27% say they'll spend less, a 4-pt improvement from previously.

Putting the Findings in Context: As the following chart shows, the net 10-pt jump in February is the second major uptick of the past three months – and the overall reading is higher than any of the previous 9 months.

Consumer Expectations and Confidence: When we asked consumers about their impressions of the economy, we found confidence and expectations up again to their highest levels of the past year.

Consumer Expectations: One-in-three consumers (33%) now believe the overall direction of the economy will improve over the next 90 days, while only 21% think it will worsen. This represents a net 7-pt improvement since January and a striking 66-pt turnaround since the horrendous lows of six months ago.

Stock Market Confidence: In a similar positive, 39% say that they’re More Confident in the U.S. stock market than they were 90 days ago, while 19% say they’re Less Confident – an 8-pt improvement since the previous month.

Respondents were asked about their investing plans going forward, and reported their money inflow into U.S. Stocks (+13; up 6-pts) is accelerating. And although Non-U.S. Stocks (-1; up 6-pts) are still registering a money outflow, the rate is subsiding – a sign that the European Union debt crisis hasn’t immobilized consumer investing.

Bottom Line: The February ChangeWave survey results show consumer spending soaring, and bring into sharp focus the improved spending environment we’ve been tracking in our monthly surveys since November of last year.

Importantly, U.S. consumer confidence and expectations are also improving for the 6th consecutive month. As for the biggest outperformers in February – it’s Travel/Vacation, Autos, Household Repairs/Improvements, and Restaurants.

-------------------------------------------------------------------------------------------------------------

KKP (Kiran Patel) is a long time investor in the US, investing in US, Indian and Chinese markets for the last 25 years. Investing is a passion, and most recently he has ventured into real estate in the US and also a bit in India. Running user groups, teaching kids at local high school, moderating a group in the US and running Investment Clubs are his current hobbies. He also works full time for a Fortune 100 corporation.

![clip_image001[4] clip_image001[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgWuGQWlemwcvBfJvbIsTE_JWt3H6hGr0qYIrCFi-OeE2nB02NS5oxsGkOPPJdoOCoe37j9NUi0nsGEIU9LOLfbcNKR8V1g6G0s5lGLNb0DoOJBLTh357ZRRP3BZFQf7wjH1Hbgfff8Doo/?imgmax=800)

![clip_image001[6] clip_image001[6]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhdneeG0_R07VP-6WmjJUEksnGH0MK2RZ47etcJ0G1Gl6V3XFwP8WMIpI15SsdXWcLqp1HDOJy7CDXaC6rr23C17reNoC_z50PRvuYSPqYxWwib58Pmfq5l1TTMiVJ8cnpFMMAy0JnbiI4/?imgmax=800)

![clip_image001[8] clip_image001[8]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhKMxwOumElCA4Cb2ZLJIBvOmERUbZI7zSfI9WBFih-QRBpHVY2bGKcP2vO5L1pTbgh_A_0Ssu-k3hENFOuJbhUXgZe6LOXBcsGYtMKmO6jDnDWA9yFYLFp03v3JkoEiBix4XEgrstH0bs/?imgmax=800)