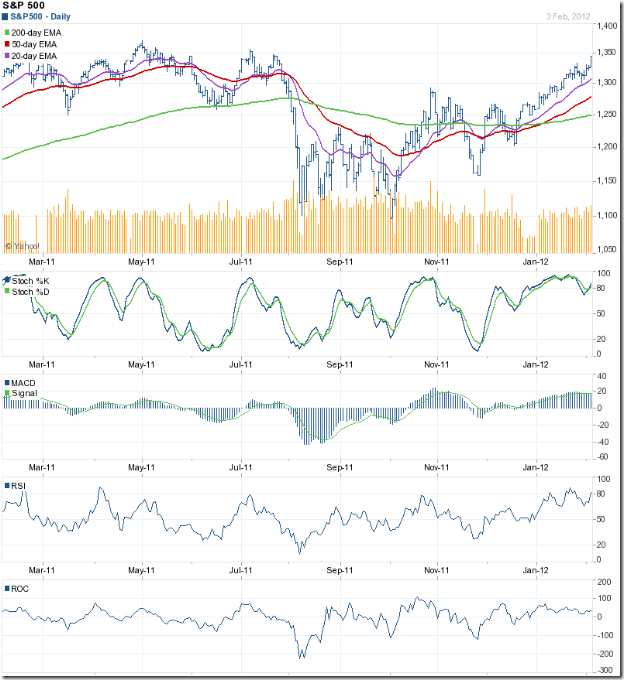

S&P 500 Index Chart

The S&P 500 index chart continued its upward march, after a brief dip to its rising 20 day EMA. All three EMAs are rising and the index is trading above them – the sign of a bull market. The May ‘11 top of 1371 is the next big hurdle on the way, but looks like the bulls will leap over it with ease.

The technical indicators are looking overbought and showing negative divergences. The index can remain overbought for long periods, but the negative divergences in all four indicators hint at a correction. The slow stochastic has re-entered its overbought zone, but touched a lower top while the index moved higher. The MACD is positive and hanging on to its signal line without rising or falling. The RSI has also re-entered its overbought zone, but touched a lower top. The ROC is positive but drifting downwards.

Last week’s jobs report was hailed by the stock market as an indication that growth in the US economy is slowly getting back on track, but all may not be well. Initial jobless claims dropped to 367,000; non-farm payrolls increased by 243,000 – much higher than consensus estimates; the unemployment rate fell to 8.3% from 8.5%. That was the good news. The bad news is that labour force participation dropped to a 30 years low at 63.7%. AAII sentiment survey showed a 4.6% drop in bullish sentiment to 43.8% (still above its historical average of 39%), and bearish sentiment rose by 6.2% to 25.1% (below its historical average of 30%).

FTSE 100 Index Chart

The FTSE 100 chart has re-entered a bull market, after a short correction down to its rising 20 day EMA. The index closed at its highest level since Jul ‘11, but all four technical indicators are showing negative divergences by failing to reach higher tops. Another correction may be around the corner.

The technical indicators are looking bullish. The slow stochastic has climbed into its overbought zone after a sharp drop from a head-and-shoulders pattern. The MACD is positive and just above its signal line. The RSI bounced up from its 50% level, and rising towards its overbought zone. The ROC took support at its ‘0’ line and is moving up in positive territory.

UK’s manufacturing and services sectors enjoyed a decent start to 2012. The manufacturing PMI survey reading rose to 52.1 in Jan ‘12 from 49.7 in Dec ‘11, indicating a return to expansion. The services sector PMI rose to 56 in Jan ‘12 from 54 in Dec ‘11. A recession may be avoided if this rate of expansion persists, since the services sector forms 2/3rds of the UK economy. The bad news came from the Eurozone, where manufacturing PMI was at 48.8 in Jan ‘12 – up from 46.9 in Dec ‘11. A figure below 50 is a sign of contraction. Small and medium businesses in the UK are facing tough times, as bank lending is at its lowest level since 2009. Another dose of QE may be in the offing.

Bottomline? Chart patterns of the S&P 500 and FTSE 100 indices are back in bull markets – discounting the slow and tortuous growth in the US and UK economies. Bull rallies in both indices have been quite sharp. Likely corrections will restore the energy of the bulls. Use dips to add.