Several bullish arguments were put forth in last week’s analysis of the BSE Sensex and NSE Nifty 50 weekly closing chart patterns. All attempts by the bulls to breach the down trend lines came to nought, as the FIIs remained net sellers last week. DII buying could not prevent both indices from dropping down to their 50 day EMAs.

BSE Sensex Index Chart

To get a better sense of Sensex movements, an ascending triangle with 18700 level as the flat top has been drawn. The zone between 18700 and 19000 is a support/resistance area. The Sensex has received support last week from the 50 day EMA, which coincides with the 19000 level.

The technical indicators are looking quite bearish. The MACD is falling below its signal line, though both are still positive. The ROC touched its 10 day MA, then dropped like a stone into negative territory. Both the RSI and slow stochastic are below their 50% levels, and heading down. The down trend that started from the Nov ‘10 top is intact.

The 200 day EMA is a little above the 18700 level. The two together may provide strong resistance if the Sensex falls further. Below that, the upward sloping trend line of the ascending triangle is another likely support. If the FII selling continues, the Sensex can drop to the longer-term support level of 17600.

The down trend line needs to be breached on strong volumes for the bulls to regain control.

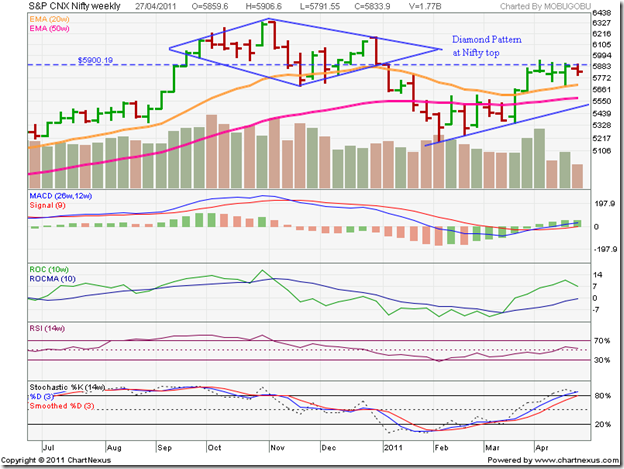

Nifty 50 Index Chart

The break out from the ascending triangle pattern was accompanied by rising volumes, indicating that the break out was a valid one. But the upside target of 6020 could not be met, as the Nifty ran into strong resistance from the down trend line.

The zone between 5600 and 5700 should provide good support, in case the Nifty falls further. Below that, the upward sloping trend line of the ascending triangle may provide support. If the Nifty drops more – continued FII selling could trigger that – it may test the long-term support at 5300.

High volumes on down-days during April ‘11 is a sign of distribution. Since retail participation has dwindled, the logical assumption is that stocks are moving from FII accounts to DII accounts. The markets have already discounted a likely 25 bps interest rate hike by the RBI next week. If the actual hike is 50 bps, there can be more selling. Q4 results have been mixed so far. Higher commodity prices and interest rates appear to be taking a toll on margins. But sales growth seems to be on track.

Bottomline? The BSE Sensex and Nifty 50 index chart patterns are struggling to avoid another drop into bear markets. Caution should be the watch word. If you are in profits, book some of it and stash it away in a bank fixed deposit. That will enable you to buy another day.

![clip_image002[5] clip_image002[5]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjwqKOatgzqavYkgGQbl_9GONk6hq5G7-z3X2sNZOfepF3u4iYTtllGzFzq0pOvEYhvec1svVXoNnzzQdtdyAF8zPdsz_7kqDWWMDGU3mgGhoolMGFAaiv84Y0hqzMUV8b4AP6D17tBIy0/?imgmax=800)