There is only one conclusion that can be drawn from the chart patterns of the BSE Sensex and Nifty 50 indices – the last of the bears seem to have been overwhelmed by a tsunami of FII buying. Are happy days here again for the bulls? Let us look at the charts to find out.

BSE Sensex Index Chart

The break out above the ‘flag’ consolidation pattern and the resistance level of 19150 occurred simultaneously, and the Sensex moved up to a 2 months high of 19575 before pulling back a bit. Note that 19650 is the 61.8% Fibonacci retracement level of the entire correction from the Nov ‘10 top 0f 21109 to the Feb ‘11 bottom of 17296. The Sensex stopped just short of it.

Technically, a breach of the 61.8% Fibonacci retracement level confirms a change of trend. The ‘golden cross’ of the 50 day EMA above the 200 day EMA that confirms a bull market hasn’t occurred yet. But it seems just a matter of time. It is likely that the bears may put up a last ditch effort to prevent the bulls from regaining control. A bit of consolidation between 19150 and 19650 levels is quite possible. On the way up, the 19650 level and the downward sloping trend line are likely to provide resistances. But the trend seems to have changed, and another sharp up move won’t be a surprise.

The technical indicators are looking quite bullish. The MACD has moved well above its signal line in positive territory. The ROC is above its 10 day MA inside the positive zone, and has reached a higher top than the ones touched in Nov ‘10 and Jan ‘11. The RSI has turned back after briefly entering its overbought zone, which is usually the sign of a consolidation or correction. The slow stochastic is inside its overbought zone.

The Sensex is less than 10% below its Nov ‘10 top. Buying should be very stock specific, with strict stop-losses.

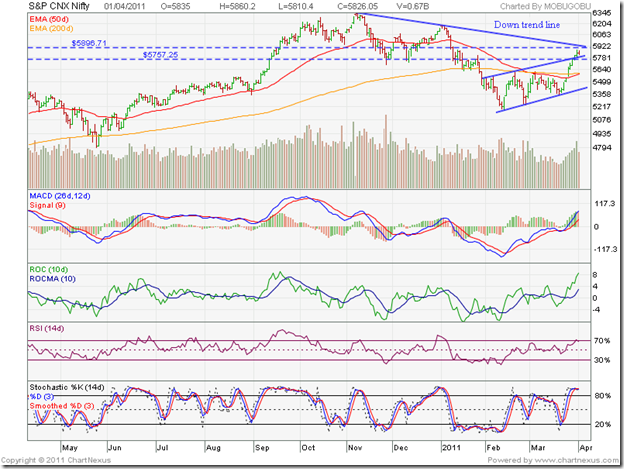

Nifty 50 Index Chart

Rising volumes during the week’s rally is a good sign that buying interest is returning. The break out above the ‘flag’ pattern saw a volume spurt.

Food inflation dropped below 10%. March ‘11 auto sales was robust. European and US markets have recovered from their recent corrections. Communist governments in Kerala and West Bengal are likely to be dethroned in the forthcoming elections. Cricket diplomacy between Pakistan and India has broken the talks impasse. India’s current account deficit came in much lower than consensus estimates.

The spate of good news has provided just the fillip that the bulls needed. The 5895 level, which is the 61.8% Fibonacci retracement level of the entire correction from the Nov ‘10 peak of 6338 to the Feb ‘11 trough of 5178, is where the bears may try to fight back. The down trend line is just above it. A breach of both would mean a likely test of the Jan ‘11 and Nov ‘10 tops.

Q4 results will determine whether the bulls will be able to regain complete control. There are expectations of slow down in some pockets. The infrastructure and capital goods sectors are still struggling. The recent placement season at the IIMs went off extremely well, with number of offers and total pay packages exceeding last year’s figures. Corporate India seems to be chugging along nicely, in spite of the higher interest rates.

Bottomline? The chart patterns of the BSE Sensex and Nifty 50 indices are on the verge of returning to confirmed bull markets. Buying the dips should be the strategy. But maintain trailing stop-losses to protect profits.